Xcel Energy 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

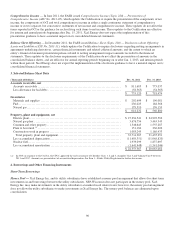

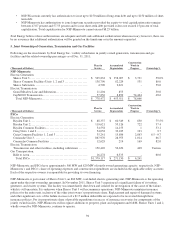

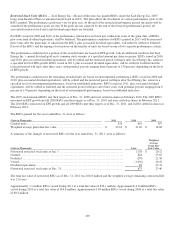

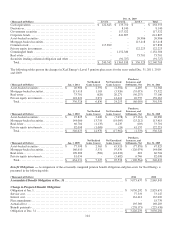

A reconciliation of the beginning and ending amount of unrecognized tax benefit is as follows:

(Millions of Dollars) 2011 2010 2009

Balance at Jan. 1 ................................

..............................

$

40.5 $

30.3 $

42.1

Additions based on tax positions related to the current year - continuing operations

..

11.9 13.4

12.6

Reductions based on tax positions related to the current year - continuing

operations................................................................

...

(1.9) (0.6)

(1.8

)

Additions for tax positions of prior years - continuing operations

..................

14.0 5.5

6.8

Reductions for tax positions of prior years - continuing operations

.................

(2.4) (1.8)

(2.3

)

Reductions for tax positions of prior years - discontinued operations

...............

- (6.3)

-

Settlements with taxing authorities - continuing operations

........................

(27.3) -

(27.1

)

Lapse of applicable statutes of limitations - continuing operations

.................

(0.1) -

-

Balance at Dec. 31................................

.............................

$

34.7 $

40.5 $

30.3

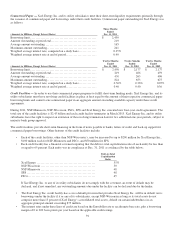

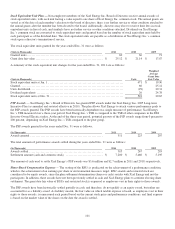

The unrecognized tax benefit amounts were reduced by the tax benefits associated with NOL and tax credit carryforwards. The

amounts of tax benefits associated with NOL and tax credit carryfowards are as follows:

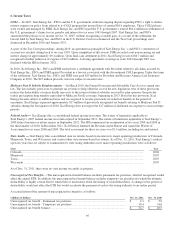

(Millions of Dollars) Dec. 31, 2011

Dec. 31, 2010

NOL and tax credit carryforwards................................

...........................

$

(33.6) $

(38.0)

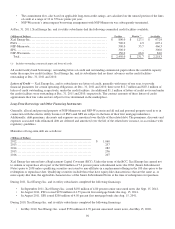

The decrease in the unrecognized tax benefit balance of $5.8 million in 2011 was due to the resolution of certain federal audit

matters, partially offset by an increase due to the addition of uncertain tax positions related to current and prior years’ activity.

Xcel Energy’s amount of unrecognized tax benefits could change in the next 12 months as the IRS and state audits resume. At this

time, due to the uncertain nature of the audit process, it is not reasonably possible to estimate an overall range of possible change.

However, Xcel Energy does not anticipate total unrecognized tax benefits will significantly change within the next 12 months.

The payable for interest related to unrecognized tax benefits is substantially offset by the interest benefit associated with NOL and

tax credit carryforwards. A reconciliation of the beginning and ending amount of the payable for interest related to unrecognized

tax benefits reported is as follows:

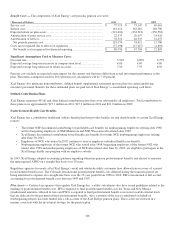

(Millions of Dollars) 2011 2010 2009

Payable for interest related to unrecognized tax benefits at Jan. 1

..................

$

(0.3) $

(0.2) $

(0.4

)

Interest income (expense) related to unrecognized tax benefits - continuing

operations................................................................

...

0.9 (0.6)

1.5

Interest (expense) income related to unrecognized tax benefits - discontinued

operations................................................................

...

(0.8) 0.5

(1.3

)

Payable for interest related to unrecognized tax benefits at Dec. 31

.................

$

(0.2) $

(0.3) $

(0.2

)

No amounts were accrued for penalties related to unrecognized tax benefits as of Dec. 31, 2011, 2010 or 2009.

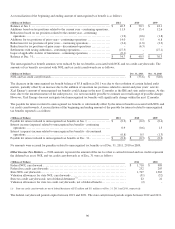

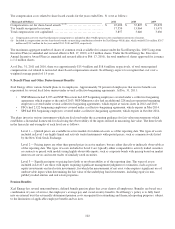

Other Income Tax Matters — NOL amounts represent the amount of the tax loss that is carried forward and tax credits represent

the deferred tax asset. NOL and tax credit carryforwards as of Dec. 31 were as follows:

(Millions of Dollars) 2011 2010

Federal NOL carryforward ................................................................

.

$

1,710 $

989

Federal tax credit carryforwards ................................

............................

232 205

State NOL carryforwards................................................................

...

1,707 1,363

Valuation allowances for state NOL carryforwards ................................

...........

(51) (32)

State tax credit carryforwards, net of federal detriment (a)................................

......

22 21

Valuation allowances for state tax credit carryforwards, net of federal benefit

...................

(2) -

(a) State tax credit carryforwards are net of federal detriment of $12 million and $11 million as of Dec. 31, 2011 and 2010, respectively.

The federal carryforward periods expire between 2021 and 2031. The state carryforward periods expire between 2012 and 2031.