Xcel Energy 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

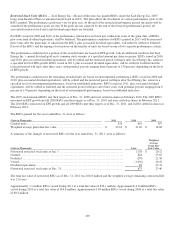

Restricted Stock Units (RSUs) — Xcel Energy Inc.’s Board of Directors has granted RSUs under the Xcel Energy Inc. 2005

Long-term Incentive Plan (as amended and restated in 2010). The plan allows the attachment of various performance goals to the

RSUs granted. The performance goals may vary by plan year. At the end of the restricted performance period, the grants will be

awarded if the performance goals are met. If the goals are not achieved by the end of the restricted performance period, all

associated restricted stock units and dividend equivalents are forfeited.

For RSUs issued in 2009 and 2010, if the performance criteria have not been met within four years of the grant date, all RSUs,

plus associated dividend equivalents, shall be forfeited. The performance conditions for RSUs granted in 2011 will be measured

three years after the grant date, at which time the RSUs, plus associated dividend equivalents, will either be settled or forfeited.

Payout of the RSUs and the lapsing of restrictions on the transfer of units are based on one of two separate performance criteria.

The performance conditions for a portion of the awarded units are based on EPS growth, with an additional condition that Xcel

Energy Inc.’s annual dividend paid on its common stock remains at a specified amount per share or greater. RSUs issued in 2009

and 2010, plus associated dividend equivalents, will be settled and the restricted period will lapse after Xcel Energy Inc. achieves

a specified level of EPS growth. RSUs issued in 2011, plus associated dividend equivalents, will be settled or forfeited and the

restricted period will lapse after three years, with potential payouts ranging from 0 percent to 150 percent, depending on the level

of EPS growth.

The performance conditions for the remaining awarded units are based on environmental performance. RSUs issued in 2009 and

2010, plus associated dividend equivalents, will be settled and the restricted period will lapse after Xcel Energy Inc. achieves a

specified level of environmental performance, based on established indicators. RSUs issued in 2011, plus associated dividend

equivalents, will be settled or forfeited and the restricted period will lapse after three years with potential payouts ranging from 0

percent to 150 percent, depending on the level of environmental performance, based on established indicators.

The 2007 environmental RSUs met their target as of Dec. 31, 2009 and were settled in shares in February 2010. The 2007 RSUs

measured on EPS growth and all 2008 RSUs met their targets as of Dec. 31, 2010 and were settled in shares in February 2011.

The 2010 RSUs measured on EPS growth and all 2009 RSUs met their targets as of Dec. 31, 2011, and will be settled in shares in

February 2012.

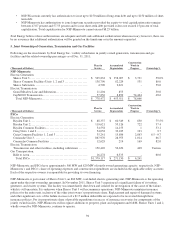

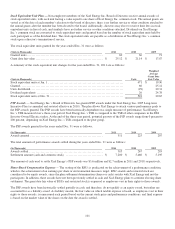

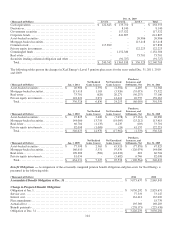

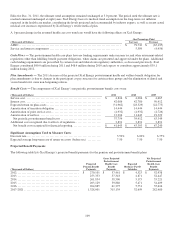

The RSUs granted for the years ended Dec. 31 were as follows:

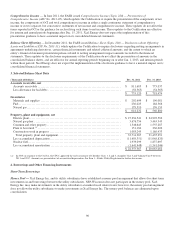

(Units in Thousands) 2011 2010 2009

Granted units................................

............................

828 601 597

Weighted average grant date fair value ................................

....

$

23.63 $

21.26 $

18.88

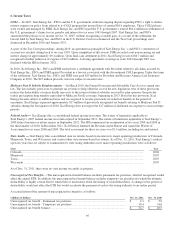

A summary of the changes of nonvested RSUs for the year ended Dec. 31, 2011, were as follows:

(Units in Thousands) Units

Weighted

Average

Grant Date

Fair Value

Nonvested restricted stock units at Jan. 1 ................................

..................

1,138 $

20.12

Granted................................................................

.................

828 23.63

Forfeited................................................................

................

(270) 21.50

Vested................................................................

..................

(1,091) 20.45

Dividend equivalents ................................................................

....

68 21.18

Nonvested restricted stock units at Dec. 31................................

.................

673 23.46

The total fair value of nonvested RSUs as of Dec. 31, 2011 was $18.6 million and the weighted average remaining contractual life

was 2.0 years.

Approximately 1.1 million RSUs vested during 2011 at a total fair value of $30.1 million. Approximately 0.6 million RSUs

vested during 2010 at a total fair value of $14.8 million. Approximately 0.04 million RSUs vested during 2009 at a total fair value

of $0.8 million.