Xcel Energy 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.121

In November 2011, PSCo filed a petition to implement interim rates, subject to refund, of $100 million to be effective in January

2012. On Jan. 11, 2012, the CPUC denied PSCo’s request to implement an interim electric rate increase of $100 million on the

basis that it had not demonstrated adverse financial impacts. On Jan. 12, 2012, PSCo filed for reconsideration of the CPUC’s

decision to deny interim rates, and requested that the CPUC authorize interim rates of approximately $42 million, specifically

related to the impacts resulting from the expiration of the Black Hills contract. On Jan. 17, 2012, the CPUC denied the request for

reconsideration. However, on Jan. 27, 2012, the CPUC approved PSCo’s request for deferred accounting of the $42 million

annual revenue requirement associated with the Black Hills contract.

Pending Regulatory Proceedings — FERC

Base Rate

PSCo Wholesale Electric Rate Case — In February 2011, PSCo filed with the FERC to change Colorado wholesale electric rates

to formula based rates with an expected annual increase of $16.1 million for 2011. The request was based on a 2011 forecast test

year, a 10.9 percent ROE, a rate base of $407.4 million and an equity ratio of 57.1 percent. The formula rate would be estimated

each year for the following year and then trued-up to actual costs after the conclusion of the calendar year. A decision is expected

in the first quarter of 2012.

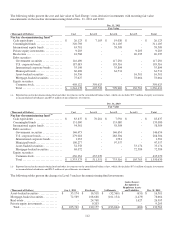

Electric, Purchased Gas and Resource Incentive Adjustment Clauses

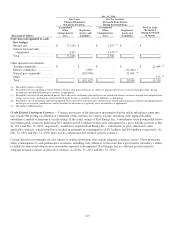

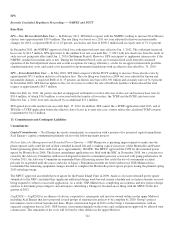

PSCo has several retail adjustment clauses that recover fuel, purchased energy, other resource costs, lost margins and/or

performance incentives, which are generally recovered concurrently through riders and base rates. At Dec. 31, 2011, pending

adjustment clauses, which contain amounts related to incentive programs were as follows:

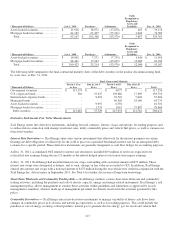

DSM and the DSMCA — The CPUC approved higher savings goals and a slightly higher financial incentive mechanism for

PSCo’s electric DSM energy efficiency programs starting in 2012. Savings goals will increase to 130 percent of the current goals

and incentives will be awarded as one installment in the year following plan achievements. PSCo will also be able to earn an

incentive on 11 percent of net economic benefits at an achievement level of 130 percent and a maximum annual incentive of $30

million.

The CPUC approved the PSCo electric DSM budget of $77.3 million and gas DSM budget of $12.2 million effective Jan. 1, 2012.

This is in addition to $29.4 million for electricity demand response programs recovered through the DSMCA. Energy efficiency

and demand response related DSM costs are recovered through a combination of the DSMCA riders and base rates. The DSMCA

riders are adjusted biannually to capture program costs, performance incentives, and any over- or under-recoveries are trued-up in

the following year.

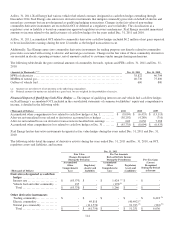

REC Sharing — In May 2011, the CPUC determined that margin sharing on stand-alone REC transactions would be shared

20 percent to PSCo and 80 percent to customers beginning in 2011 and ultimately becoming 10 percent to PSCo and 90 percent to

customers by 2014. The CPUC also approved a change to the treatment of hybrid REC trading margins (RECs that are bundled

with energy) that allows the customers’ share of the margins to be netted against the RESA regulatory asset balance. In the second

quarter of 2011, PSCo credited approximately $37 million against the RESA regulatory asset balance.

In June 2011, PSCo filed an application with the CPUC for permanent treatment of RECs that are bundled with energy into

California. The application is seeking margin sharing of 30 percent to PSCo and 70 percent to customers for deliveries outside of

California and 40 percent to PSCo and 60 percent to customers for deliveries inside of California. PSCo also proposed that sales

of RECs bundled with on-system energy be aggregated with other trading margins and shared 20 percent to PSCo and 80 percent

to customers. In September 2011, the CPUC Staff, the OCC, and the Colorado Energy Consumers filed answer testimony

requesting the CPUC approve margin sharing of 8 percent to 25 percent to PSCo for deliveries outside of California and 8 percent

to 35 percent for deliveries inside of California.

In January 2012, the CPUC approved the margin sharing on the first $20 million of margins on hybrid REC trades of 80 percent

to the customers and 20 percent to PSCo. Margins in excess of the $20 million are to be shared 90 percent to the customers and 10

percent to PSCo. All customer margin sharing and unspent carbon offset funds will be credited to the RESA regulatory asset

balance. Because the sharing percentage was less than recommended by the CPUC Staff, OCC, and the Colorado Energy

Consumers, PSCo plans to file an Application for Rehearing, Rearguement and Reconsideration during the first quarter of 2012.