Xcel Energy 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

Diluted EPS reflects the potential dilution that could occur if securities or other agreements to issue common stock (i.e., common

stock equivalents), such as equity forward agreements or stock options and other share-based compensation awards were settled.

Common Stock Equivalents — Xcel Energy Inc. currently has common stock equivalents consisting of 401(k) equity awards and

stock options, and in 2010, also had equity forward instruments. The weighted average number of potentially dilutive shares

outstanding used to calculate Xcel Energy Inc.’s diluted EPS is calculated based on the treasury stock method.

Equity Forward Agreements

In August 2010, Xcel Energy Inc. entered into equity forward agreements in connection with a public offering of 21.85 million

shares of its common stock. Under the equity forward agreements (Forward Agreements), Xcel Energy Inc. agreed to issue to the

banking counterparty 21.85 million shares of its common stock.

The equity forward instruments were accounted for as equity and recorded at fair value at the execution of the Forward

Agreements, and were not subsequently adjusted for changes in fair value until settlement. Based upon the market terms of the

equity forward instruments, including initial pricing of $20.855 per share determined based on the August 2010 offering price of

Xcel Energy Inc.’s common stock of $21.50 per share less underwriting fees of $0.645 per share, and as no premium on the

transaction was owed either party to the Forward Agreements at execution, no fair value was recorded to equity for the

instruments when the Forward Agreements were entered. The Forward Agreements settled on Nov. 29, 2010 and the proceeds of

$449.8 million were recorded to common stock and additional paid in capital.

Share-Based Compensation

Common stock equivalents related to share-based compensation causing dilutive impact to EPS historically have included 401(k)

equity awards and stock options. Stock equivalent units granted to Xcel Energy Inc.’s Board of Directors are included in common

shares outstanding upon grant date as there is no further service, performance or market condition associated with these awards.

Restricted stock, granted to settle amounts due certain employees under the Xcel Energy Inc. Executive Annual Incentive Award

Plan, is included in common shares outstanding when granted, pending remaining service conditions.

Share-based compensation arrangements for which there is currently no dilutive impact to EPS include the following:

• RSU equity awards subject to a performance condition; included in common shares outstanding when all necessary

conditions for settlement have been satisfied by the end of the reporting period.

• PSP liability awards subject to a performance condition; any portions settled in shares are included in common shares

outstanding upon settlement.

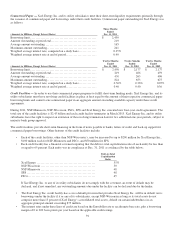

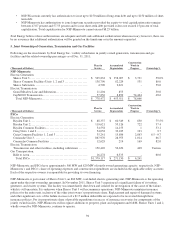

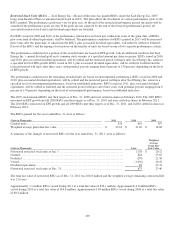

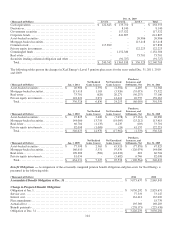

The dilutive impact of common stock equivalents affecting EPS was as follows for the years ending Dec. 31:

2011 2010 2009

(Amounts in thousands,

except per share data) Income Share

Per

Share

Amount

Income Share

Per

Share

Amount

Income Share

Per

Share

Amount

Net income

..................

$

841,172

$

755,834

$

680,887

Less: Dividend requirements on

preferred stock

.............

(3,534)

(4,241

)

(4,241)

Less: Premium on redemption of

preferred stock

.............

(3,260)

-

-

Basic earnings per share:

Earnings available to common

shareholders

...............

834,378 485,039

$

1.72

751,593

462,052

$

1.63 676,646 456,433 $

1.48

Effect of dilutive securities:

Equity forward instruments

....

- -

-

700

- -

401(k) equity awards

........

- 576

-

639

- 705

Stock options

..............

- -

-

-

- 1

Diluted earnings per share:

Earnings available to common

shareholders

...............

$

834,378 485,615

$

1.72

$

751,593

463,391

$

1.62 $

676,646 457,139 $

1.48

In 2011, 2010 and 2009, Xcel Energy Inc. had approximately 2.1 million, 5.4 million and 7.6 million weighted average options

outstanding, respectively, that were antidilutive, and therefore, excluded from the earnings per share calculation.