Xcel Energy 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.135

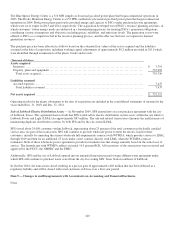

In August 2009, PSCo filed an answer and counterclaim denying the allegations in the complaint and alleging that Shaw failed to

discharge its contractual obligations and caused delays, and that PSCo is entitled to liquidated damages and excess costs incurred

of approximately $82 million.

Following a November 2010 jury trial and subsequent appeal, in November 2011, a confidential settlement was reached

dismissing all actions. This settlement did not have a material effect on Xcel Energy’s consolidated results of operations, cash

flows or financial position.

Merricourt Wind Project Litigation — On April 1, 2011, NSP-Minnesota terminated its agreements with enXco Development

Corporation (enXco) for the development of a 150 MW wind project in southeastern North Dakota. NSP-Minnesota’s decision to

terminate the agreements was based in large part on the adverse impact this project could have on endangered or threatened

species protected by federal law and the uncertainty in cost and timing in mitigating this impact. NSP-Minnesota also terminated

the agreements due to enXco’s nonperformance of certain other conditions, including failure to obtain a Certificate of Site

Compatibility and the failure to close on the contracts by an agreed upon date of March 31, 2011. As a result, NSP-Minnesota

recorded a $101 million deposit in the first quarter 2011, which was collected in April 2011. On May 5, 2011, NSP-Minnesota

filed a declaratory judgment action in U.S. District Court in Minnesota to obtain a determination that it acted properly in

terminating the agreements. On that same day, enXco also filed a separate lawsuit in the same court seeking, among other things,

in excess of $240 million for an alleged breach of contract. NSP-Minnesota believes enXco’s lawsuit is without merit and has

filed a motion to dismiss. On Sept. 16, 2011, the U.S. District Court denied the motion to dismiss. The trial is set to begin in late

2012 or early 2013. While Xcel Energy believes the likelihood of loss is remote, given the nature of this case and any surrounding

uncertainty, it may have a material impact on Xcel Energy’s consolidated results of operations, cash flows or financial position.

No accrual has been recorded for this matter.

Other Contingencies

See Note 12 for further discussion.

14. Nuclear Obligations

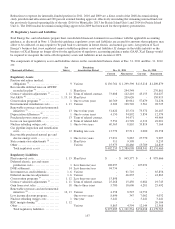

Fuel Disposal — NSP-Minnesota is responsible for temporarily storing used or spent nuclear fuel from its nuclear plants. The

DOE is responsible for permanently storing spent fuel from NSP-Minnesota’s nuclear plants as well as from other U.S. nuclear

plants. NSP-Minnesota has funded its portion of the DOE’s permanent disposal program since 1981. The fuel disposal fees are

based on a charge of 0.1 cent per KWh sold to customers from nuclear generation. Fuel expense includes the DOE fuel disposal

assessments of approximately $11 million in 2011, $13 million in 2010 and $12 million in 2009. In total, NSP-Minnesota had

paid approximately $422.3 million to the DOE through Dec. 31, 2011. The Nuclear Waste Policy Act of 1982 required the DOE

to begin accepting spent nuclear fuel no later than Jan. 31, 1998. NSP-Minnesota and other utilities have commenced lawsuits

against the DOE to recover damages caused by the DOE’s failure to meet its statutory and contractual obligations. In 2011, NSP-

Minnesota received from the DOE pursuant to a Settlement with the DOE, an initial payment of approximately $100 million to

cover damages through the end of 2008. As of Dec. 31, 2011, NSP-Minnesota has recorded the payment as restricted cash and a

regulatory liability.

NSP-Minnesota has its own temporary on-site storage facilities for spent fuel at its Monticello and Prairie Island nuclear plants,

which consist of storage pools and dry cask facilities at both sites. The amount of spent fuel storage capacity currently authorized

by the NRC and the MPUC will allow NSP-Minnesota to continue operation of its Prairie Island nuclear plant until the end of its

renewed licenses terms in 2033 for Unit 1 and 2034 for Unit 2 and its Monticello nuclear plant until the end of its renewed

operating license in 2030. Other alternatives for spent fuel storage are being investigated until a DOE facility is available,

including pursuing the establishment of a private facility for interim storage of spent nuclear fuel as part of a consortium of

electric utilities.

Regulatory Plant Decommissioning Recovery — Decommissioning of NSP-Minnesota’s nuclear facilities is planned for the

period from cessation of operations through at least 2067, assuming the prompt dismantlement method. NSP-Minnesota is

currently recording the regulatory costs for decommissioning over the MPUC-approved cost-recovery period and including the

accruals in a regulatory liability account. The total decommissioning cost obligation is recorded as an ARO in accordance with

the applicable accounting guidance.

Monticello received its initial operating license in 1970 and began commercial operation in 1971. With its renewed operating

license and CON for spent fuel capacity to support 20 years of extended operation, Monticello can operate until 2030. The

Monticello 20-year depreciation life extension until September 2030 was granted by the MPUC in 2007. Construction of the

Monticello dry-cask storage facility is complete, and 10 of the 30 canisters authorized have been filled and placed in the facility.