Xcel Energy 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

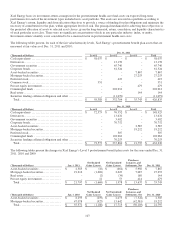

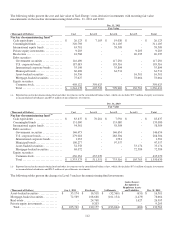

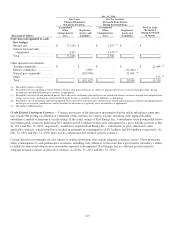

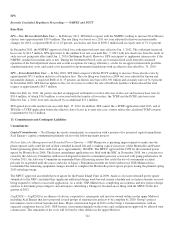

The following table presents for each of the hierarchy levels, Xcel Energy’s derivative assets and liabilities that are measured at

fair value on a recurring basis at Dec. 31, 2010:

Dec. 31, 2010

Fair Value Fair Value

Counterparty

(Thousands of Dollars) Level 1 Level 2 Level 3 Total Netting (b) Total

Current derivative assets

Derivatives designated as cash flow hedges:

Vehicle fuel and other commodity

...........

$ - $

126 $

-

$

126 $

- $

126

Other derivative instruments:

Trading commodity

.........................

487 37,019

-

37,506 (21,352) 16,154

Electric commodity

.........................

- -

3,619

3,619 (1,226) 2,393

Natural gas commodity

.....................

- 1,595

-

1,595 (1,219) 376

Total current derivative assets

.............

$ 487 $

38,740 $

3,619

$

42,846 $

(23,797) 19,049

Purchased power agreements (a)

................

35,030

Current derivative instruments

...............

$

54,079

Noncurrent derivative assets

Derivatives designated as cash flow hedges:

Vehicle fuel and other commodity

...........

$ - $

150 $

-

$

150 $

- $

150

Other derivative instruments:

Trading commodity

.........................

- 32,621

-

32,621 (4,595) 28,026

Natural gas commodity

.....................

- 1,246

-

1,246 (269) 977

Total noncurrent derivative assets

..........

$ - $

34,017 $

-

$

34,017 $

(4,864) 29,153

Purchased power agreements (a)

................

154,873

Noncurrent derivative instruments

...........

$

184,026

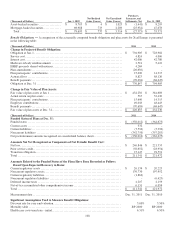

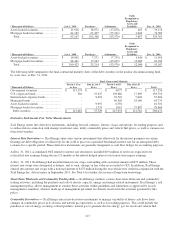

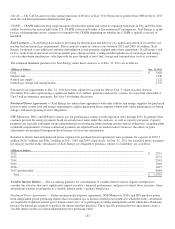

Dec. 31, 2010

Fair Value Fair Value

Counterparty

(Thousands of Dollars) Level 1 Level 2 Level 3 Total Netting (b) Total

Current derivative liabilities

Other derivative instruments:

Trading commodity

.........................

$

392 $

30,608 $

- $

31,000

$

(24,007) $

6,993

Electric commodity

.........................

- - 1,227

1,227

(1,227) -

Natural gas commodity

.....................

20 52,709 -

52,729

(21,169) 31,560

Total current derivative liabilities

..........

$

412 $

83,317 $

1,227 $

84,956

$

(46,403) 38,553

Purchased power agreements (a)

................

23,192

Current derivative instruments

...............

$

61,745

Noncurrent derivative liabilities

Other derivative instruments:

Trading commodity

.........................

$

- $

18,878 $

- $

18,878

$

(4,596) $

14,282

Natural gas commodity

.....................

- 438 -

438

(269) 169

Total noncurrent derivative liabilities

.......

$

- $

19,316 $

- $

19,316

$

(4,865) 14,451

Purchased power agreements (a)

................

271,535

Noncurrent derivative instruments

...........

$

285,986

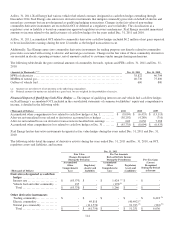

(a) In 2003, as a result of implementing new guidance on the normal purchase exception for derivative accounting, Xcel Energy began recording several long-

term purchased power agreements at fair value due to accounting requirements related to underlying price adjustments. As these purchases are recovered

through normal regulatory recovery mechanisms in the respective jurisdictions, the changes in fair value for these contracts were offset by regulatory assets

and liabilities. During 2006, Xcel Energy qualified these contracts under the normal purchase exception. Based on this qualification, the contracts are no

longer adjusted to fair value and the previous carrying value of these contracts will be amortized over the remaining contract lives along with the offsetting

regulatory assets and liabilities.

(b) The accounting guidance for derivatives and hedging permits the netting of receivables and payables for derivatives and related collateral amounts when a

legally enforceable master netting agreement exists between Xcel Energy and a counterparty. A master netting agreement is an agreement between two

parties who have multiple contracts with each other that provides for the net settlement of all contracts in the event of default on or termination of any one

contract.