Xcel Energy 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

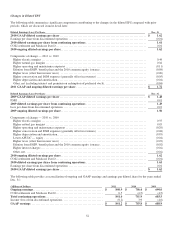

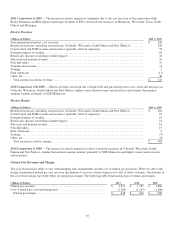

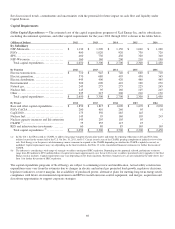

Depreciation and Amortization — Depreciation and amortization expense increased $31.7 million, or 3.7 percent for 2011,

compared with 2010. This increase in depreciation expense is primarily due to several capital projects going into service,

including a portion of the Monticello extended power uprate going into service in May 2011, the Nobles wind project

commencing commercial operations in late 2010, the acquisition of two PSCo gas generation facilities in December 2010, Jones

Unit 3 going into service in June 2011 and normal system expansion. The increase was partially offset due to NSP-Minnesota

reducing depreciation expense by approximately $30 million in the fourth quarter of 2011 to reflect the proposed settlement in the

Minnesota electric rate case.

Depreciation and amortization expenses increased $40.8 million, or 5.0 percent for 2010, compared with 2009. The change in

depreciation expense was primarily due to Comanche Unit 3 going into service and normal system expansion.

Taxes (Other Than Income Taxes) — Taxes (other than income taxes) increased $42.9 million, or 12.9 percent for 2011,

compared with 2010. The change is primarily due to an increase in 2011 for property taxes of approximately $29.6 million in

Colorado and $8.8 million in Minnesota.

Taxes (other than income taxes) increased $25.5 million, or 8.3 percent for 2010, compared with 2009. The change was primarily

due to an increase in property taxes in Colorado and in Minnesota.

Other Income, Net — Other income, net decreased $21.9 million for 2011, compared with 2010, and increased $21.4 million for

2010, compared with 2009. The changes were primarily due to the COLI settlement in July 2010.

AFUDC — AFUDC decreased $5.4 million, or 6.4 percent for 2011, compared with 2010. The decrease is primarily due to lower

AFUDC rates and lower average CWIP. The lower average CWIP is attributed to Comanche Unit 3 and the Nobles wind project

going into service in 2010, offset by Monticello extended power uprate and work at the Jones plant, as well as SPS transmission

projects in 2011.

AFUDC decreased $30.7 million for 2010, compared with 2009. The decrease was partially due to Comanche Unit 3 going into

service in May 2010, as well as lower interest rates.

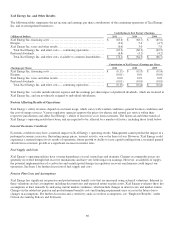

Interest Charges — Interest charges increased $13.8 million, or 2.4 percent for 2011, compared with 2010, and $15.6 million, or

2.8 percent for 2010, compared with 2009. The increase was due to higher long-term debt levels necessary to fund investments in

utility operations, partially offset by lower interest rates.

Income Taxes — Income tax expense for continuing operations increased $31.7 million for 2011, compared with 2010. The

increase is primarily due to higher pretax income, a net change in tax valuation allowances of $8.9 million, and the non-taxability

of the Provident settlement in 2010. These were partially offset by the 2010 write-off of the tax benefit for Medicare Part D

subsidies, an adjustment related to COLI and an increase in 2011 wind production tax credits. The effective tax rate for

continuing operations was 35.8 percent for 2011, compared with 36.7 percent for 2010. The higher effective tax rate for 2010 was

primarily due to the Medicare Part D, COLI, and the valuation allowance adjustments referenced above. Without these

adjustments, the effective tax rate for continuing operations for 2010 would have been 35.1 percent. See Note 6 in the notes to

consolidated financial statements for further discussion on COLI.

Income tax expense for continuing operations increased $65.3 million for 2010, compared with 2009. The increase in income tax

expense was primarily due to an increase in pretax income, and one time adjustments for a write-off of tax benefit previously

recorded for Medicare Part D subsidies and an adjustment related to the COLI Tax Court proceedings. This was partially offset by

a reversal of a valuation allowance for certain state tax credit carryovers. The effective tax rate for continuing operations was 36.7

percent for 2010 compared with 35.1 percent for 2009. The higher effective tax rate for 2010 was primarily due to the adjustments

referenced above. The effective tax rate for ongoing earnings for 2010 was 35.3 percent.

Premium on Redemption of Preferred Stock — Xcel Energy Inc. redeemed all series of its preferred stock on Oct. 31, 2011, at an

aggregate purchase price of $108 million, plus accrued dividends. As such, the redemption premium of $3.3 million and accrued

dividends are reflected as reductions to earnings available to common shareholders for 2011.