Xcel Energy 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

Comprehensive Income — In June 2011, the FASB issued Comprehensive Income (Topic 220) — Presentation of

Comprehensive Income (ASU No. 2011-05), which updates the Codification to require the presentation of the components of net

income, the components of OCI and total comprehensive income in either a single continuous statement of comprehensive

income or in two separate, but consecutive statements of net income and comprehensive income. These updates do not affect the

items reported in OCI or the guidance for reclassifying such items to net income. These updates to the Codification are effective

for interim and annual periods beginning after Dec. 15, 2011. Xcel Energy does not expect the implementation of this

presentation guidance to have a material impact on its consolidated financial statements.

Balance Sheet Offsetting — In December 2011, the FASB issued Balance Sheet (Topic 210) — Disclosures about Offsetting

Assets and Liabilities (ASU No. 2011-11), which updates the Codification to require disclosures regarding netting arrangements in

agreements underlying derivatives, certain financial instruments and related collateral amounts, and the extent to which an

entity’s financial statement presentation policies related to netting arrangements impact amounts recorded to the financial

statements. These updates to the disclosure requirements of the Codification do not affect the presentation of amounts in the

consolidated balance sheets, and are effective for annual reporting periods beginning on or after Jan. 1, 2013, and interim periods

within those periods. Xcel Energy does not expect the implementation of this disclosure guidance to have a material impact on its

consolidated financial statements.

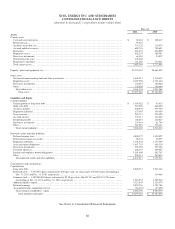

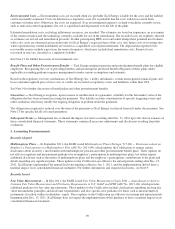

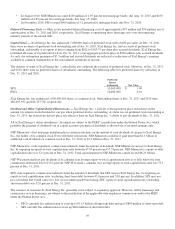

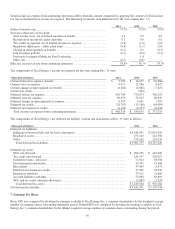

3. Selected Balance Sheet Data

(Thousands of Dollars) Dec. 31, 2011 Dec. 31, 2010

Accounts receivable, net

Accounts receivable ................................................................

.

$ 811,685 $ 773,037

Less allowance for bad debts ................................

.........................

(58,565) (54,563

)

$ 753,120 $ 718,474

Inventories

Materials and supplies ................................

...............................

$ 202,699 $ 196,081

Fuel ................................................................

................

236,023 188,566

Natural gas................................................................

..........

179,510 176,153

$ 618,232 $ 560,800

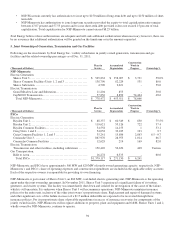

Property, plant and equipment, net

Electric plant ................................................................

........

$ 27,254,541 $ 24,993,582

Natural gas plant ................................................................

....

3,676,754 3,463,343

Common and other property ................................

..........................

1,546,643 1,555,287

Plant to be retired (a) ................................................................

.

151,184 236,606

Construction work in progress ................................

........................

1,085,245 1,186,433

Total property, plant and equipment ................................

.................

33,714,367 31,435,251

Less accumulated depreciation................................

........................

(11,658,351) (11,068,820

)

Nuclear fuel................................................................

.........

1,939,299 1,837,697

Less accumulated amortization ................................

.......................

(1,641,948) (1,541,046

)

$ 22,353,367 $ 20,663,082

(a) In 2010, in response to the CACJA, the CPUC approved the early retirement of Cherokee Units 1, 2 and 3, Arapahoe Unit 3 and Valmont Unit 5 between

2011 and 2017. Amounts are presented net of accumulated depreciation. See Item 1 – Public Utility Regulation for further discussion.

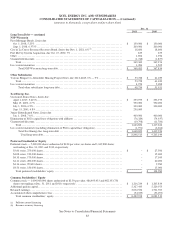

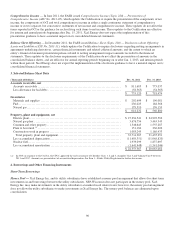

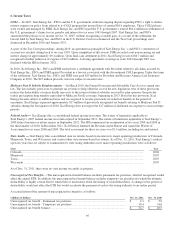

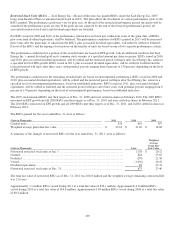

4. Borrowings and Other Financing Instruments

Short-Term Borrowings

Money Pool — Xcel Energy Inc. and its utility subsidiaries have established a money pool arrangement that allows for short-term

investments in and borrowings between the utility subsidiaries. NSP-Wisconsin does not participate in the money pool. Xcel

Energy Inc. may make investments in the utility subsidiaries at market-based interest rates; however, the money pool arrangement

does not allow the utility subsidiaries to make investments in Xcel Energy Inc. The money pool balances are eliminated upon

consolidation.