Xcel Energy 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.120

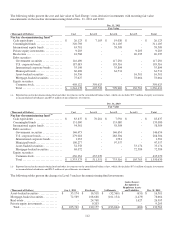

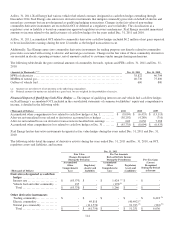

Electric, Purchased Gas and Resource Adjustment Incentive Clauses

NSP-Minnesota has several retail adjustment clauses that recover fuel, purchased energy, other resource costs, lost margins and/or

performance incentives, which are generally recovered concurrently through riders and base rates. At Dec. 31, 2011, pending

adjustment clauses, which contain amounts related to incentive programs were as follows:

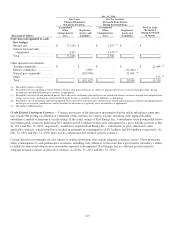

CIP Rider — CIP expenses are recovered through base rates and a rider that is adjusted annually. Under the 2010 electric CIP

rider request approved by the MPUC in October 2010, NSP-Minnesota recovered $84.4 million through the rider during

November 2010 to December 2011. This is in addition to $60.9 million recovered through base rates. During December 2010 to

December 2011, NSP-Minnesota recovered $27.4 million through the natural gas CIP rider approved in November 2010. This is

in addition to $4.4 million recovered in base rates.

In January 2012, the MPUC approved NSP-Minnesota’s annual electric rider petition requesting recovery of $74.7 million of

electric CIP expenses and financial incentives to be recovered during February 2012 through December 2012. In December 2011,

the MPUC approved NSP-Minnesota’s annual gas rider petition requesting $10.6 million of natural gas CIP expenses and

financial incentives to be recovered during January 2012 through December 2012. This proposed recovery through the riders is in

addition to an estimated $48.3 million and $3.8 million through electric and gas base rates, respectively.

NSP-Wisconsin

Recently Concluded Regulatory Proceedings — PSCW

Base Rate

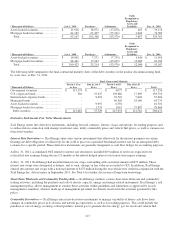

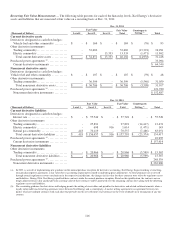

NSP-Wisconsin 2011 Electric and Gas Rate Case — In June 2011, NSP-Wisconsin filed a request with the PSCW to increase

electric rates approximately $29.2 million, or 5.1 percent and natural gas rates approximately $8.0 million, or 6.6 percent effective

Jan. 1, 2012. The rate filing is based on a 2012 forecast test year and includes a requested ROE of 10.75 percent, an equity ratio of

52.54 percent, an electric rate base of approximately $718 million and a natural gas rate base of $84 million.

In December 2011, the PSCW approved an electric rate increase of approximately $12.2 million or 2.1 percent, and a natural gas

rate increase of $2.9 million or 2.4 percent, with new rates effective Jan. 1, 2012. The primary reason for the natural gas rate

reduction from the original request was the PSCW decision to deny NSP-Wisconsin’s proposal to pre-collect certain

manufactured gas plant remediation costs. The primary reasons for the electric rate reduction were updated 2012 electric fuel

costs and the delays in the Monticello nuclear plant extended life cycle management and power uprate project. The rate increases

were based on a 10.4 percent ROE and an equity ratio of 52.59 percent.

PSCo

Pending and Recently Concluded Regulatory Proceedings — CPUC

Base Rate

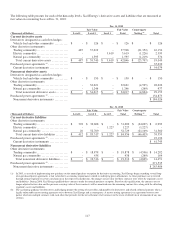

PSCo 2010 Gas Rate Case — In December 2010, PSCo filed a request with the CPUC to increase Colorado retail gas rates by

$27.5 million on an annual basis. In March 2011, PSCo revised its requested rate increase to $25.6 million. The revised request

was based on a 2011 forecast test year, a 10.9 percent ROE, a rate base of $1.1 billion and an equity ratio of 57.1 percent. PSCo

proposed recovering $23.2 million of test year capital and O&M expenses associated with several pipeline integrity costs plus an

amortization of similar costs that have been accumulated and deferred since the last rate case in 2006. PSCo also proposed

removing the earnings on gas in underground storage from base rates.

In August 2011, the CPUC approved a comprehensive settlement that PSCo reached with the CPUC Staff and the OCC to

increase rates by $12.8 million, to institute the PSIA rider, and to remove gas in underground storage from base rates and recover

those costs in the GCA. The GCA is expected to recover another $10 million of annual incremental revenue, subject to adjustment

to actual costs. Rates were set on a test year ending June 30, 2011 with an equity ratio of 56 percent and an ROE of 10.1 percent.

New base rates and the GCA recovery went into effect in September 2011. The PSIA rider and new rate designs went into effect

on Jan. 1, 2012.

PSCo 2011 Electric Rate Case — In November 2011, PSCo filed a request with the CPUC to increase Colorado retail electric

rates by $141.9 million. The request was based on a 2012 forecast test year, a 10.75 percent ROE, a rate base of $5.4 billion and

an equity ratio of 56 percent. Final rates are expected to be effective in the summer of 2012. The CPUC is expected to rule on the

electric rate case in July 2012.