Xcel Energy 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

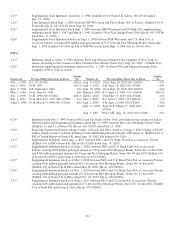

137

Reductions to expense for internally-funded portions in 2011, 2010 and 2009 are a direct result of the 2008 decommissioning

study jurisdictional allocation and 100 percent external funding approval, effectively unwinding the remaining internal fund over

the previously licensed operating life of the unit (2010 for Monticello, 2013 for Prairie Island Unit 1 and 2014 for Prairie Island

Unit 2). The 2008 nuclear decommissioning filing approved in 2009 has been used for the regulatory presentation.

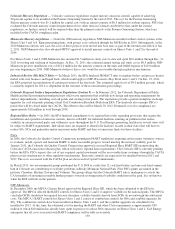

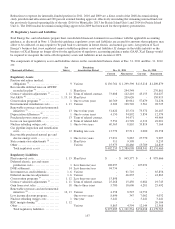

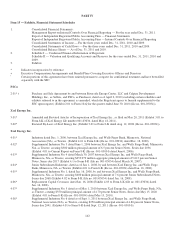

15. Regulatory Assets and Liabilities

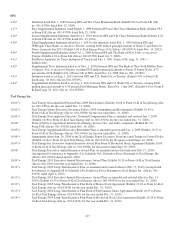

Xcel Energy Inc. and subsidiaries prepare their consolidated financial statements in accordance with the applicable accounting

guidance, as discussed in Note 1. Under this guidance, regulatory assets and liabilities are created for amounts that regulators may

allow to be collected, or may require to be paid back to customers in future electric and natural gas rates. Any portion of Xcel

Energy’s business that is not regulated cannot establish regulatory assets and liabilities. If changes in the utility industry or the

business of Xcel Energy no longer allow for the application of regulatory accounting guidance under GAAP, Xcel Energy would

be required to recognize the write-off of regulatory assets and liabilities in net income or OCI.

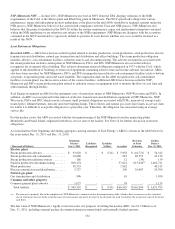

The components of regulatory assets and liabilities shown on the consolidated balance sheets at Dec. 31, 2011 and Dec. 31, 2010

are:

(Thousands of Dollars)

See

Note(s)

Remaining

Amortization Period

Dec. 31, 2011

Dec. 31, 2010

Current

Noncurrent

Current

Noncurrent

Regulatory Assets

Pension and retiree medical

obligations (a)

........................

9 Various $

130,764 $

1,299,399

$

115,218

$

1,209,879

Recoverable deferred taxes on AFUDC

recorded in plant (b)

..................

1 Plant lives - 294,549

-

276,861

Contract valuation adjustments (c)

.......

1, 11 Term of related contract

73,608 142,210

45,155

134,027

Net AROs (d)

..........................

1, 13, 14 Plant lives - 209,626

-

150,913

Conservation programs (e)

..............

1 One to seven years 46,769 80,981

57,679

74,236

Environmental remediation costs

........

1, 13 Various 2,309 109,720

3,561

98,725

Renewable resources and environmental

initiatives (b)

.........................

13 One to four years 51,622 25,378

75,372

20,487

Depreciation differences (b)

.............

1 One to seven years 4,150 54,892

5,859

12,379

Purchased power contract costs

.........

13 Term of related contract

- 54,471

-

44,464

Losses on reacquired debt

..............

4 Term of related debt 5,554 43,729

6,319

49,001

Nuclear refueling outage costs

..........

1 One to two years 40,365 8,810

33,819

7,169

Gas pipeline inspection and remediation

costs

................................

12 Pending rate case 13,779 27,511

2,000

29,358

Recoverable purchased natural gas and

electric energy costs

.................

1 One to two years 17,031 9,867

27,770

9,907

State commission adjustments (b)

........

1 Plant lives 311 9,399

-

9,235

Other

................................

Various 15,973 18,466

15,789

24,819

Total regulatory assets

...............

$

402,235 $

2,389,008

$

388,541

$

2,151,460

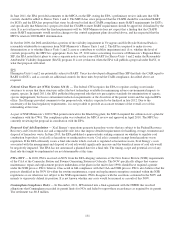

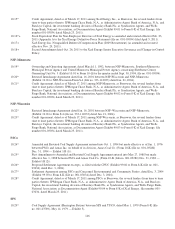

Regulatory Liabilities

Plant removal costs

....................

1, 13 Plant lives $

- $

945,377

$

-

$

979,666

Deferred electric, gas and steam

production costs

.....................

1 Less than one year 108,057 -

107,674

-

DOE settlement

.......................

14 Less than one year 94,734 -

-

-

Investment tax credit deferrals

..........

1, 6 Various - 61,710

-

65,856

Deferred income tax adjustment

........

1, 6 Various - 46,835

-

42,863

Conservation programs (e)

..............

1, 12 Less than one year 15,898 -

-

-

Contract valuation adjustments (c)

.......

1, 11 Term of related contract

25,268 15,450

6,684

19,743

Gain from asset sales

..................

18 One to three years 5,780 18,696

4,281

25,492

Renewable resources and envi

ronmental

initiatives (b)

.........................

12, 13 Various 4,358 8,525

14,752

-

Low income discount program

..........

One to two years 8,696 347

7,062

4,032

Nuclear refueling outage costs

..........

1 One year 3,441 -

3,441

3,441

REC margin sharing (f)

.................

1, 12 - -

-

26,104

Other

................................

Various 8,863 4,594

12,144

12,568

Total regulatory liabilities

............

$

275,095 $

1,101,534

$

156,038

$

1,179,765