Xcel Energy 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

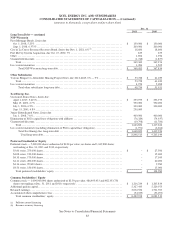

93

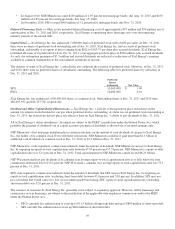

• In August 2010, NSP-Minnesota issued $250 million of 1.95 percent first mortgage bonds, due Aug. 15, 2015 and $250

million of 4.85 percent first mortgage bonds, due Aug. 15, 2040.

• In November 2010, PSCo issued $400 million of 3.2 percent first mortgage bonds, due Nov. 15, 2020.

Deferred Financing Costs — Other assets included deferred financing costs of approximately $75 million and $74 million, net of

amortization, at Dec. 31, 2011 and 2010, respectively. Xcel Energy is amortizing these financing costs over the remaining

maturity periods of the related debt.

Capital Stock — Xcel Energy Inc. has authorized 7,000,000 shares of preferred stock with a $100 par value. At Dec. 31, 2011,

there were no shares of preferred stock outstanding and at Dec. 31, 2010, Xcel Energy Inc. had six series of preferred stock

outstanding, redeemable at its option at prices ranging from $102 to $103.75 per share plus accrued dividends. Xcel Energy Inc.

redeemed all series of its preferred stock on Oct. 31, 2011, at an aggregate purchase price of $108 million, plus accrued dividends.

As such, the redemption premium of $3.3 million and accrued dividends are reflected as reductions of Xcel Energy’s earnings

available to common shareholders in the consolidated statements of income.

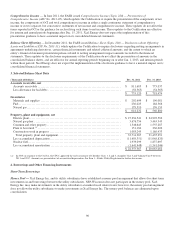

The charters of some of Xcel Energy Inc.’s subsidiaries also authorize the issuance of preferred stock. However, at Dec. 31, 2011

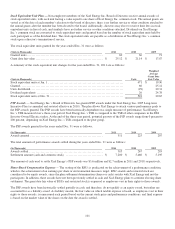

and 2010, there were no preferred shares of subsidiaries outstanding. The following table lists preferred shares by subsidiary at

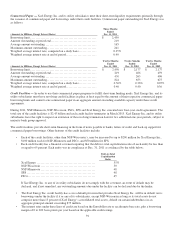

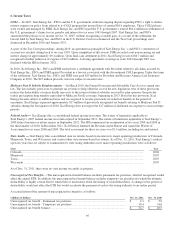

Dec. 31, 2011 and 2010:

Preferred

Shares

Authorized Par Value

SPS ................................................................

..

10,000,000 $ 1.00

PSCo ................................................................

.

10,000,000 0.01

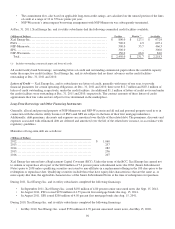

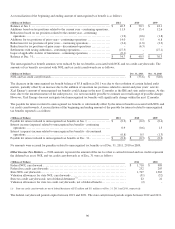

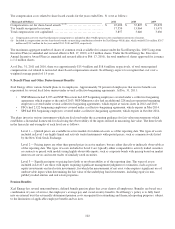

Xcel Energy Inc. has authorized 1,000,000,000 shares of common stock. Outstanding shares at Dec. 31, 2011 and 2010 were

486,493,933 and 482,333,750, respectively.

Dividend and Other Capital-Related Restrictions — Xcel Energy Inc.’s Articles of Incorporation place restrictions on the

amount of common stock dividends it can pay when preferred stock is outstanding. As there was no preferred stock outstanding at

Dec. 31, 2011, the restrictions did not place any effective limit on Xcel Energy Inc.’s ability to pay dividends at Dec. 31, 2011.

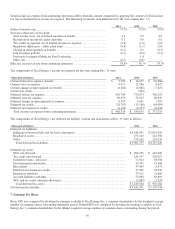

All of Xcel Energy’s utility subsidiaries’ dividends are subject to the FERC’s jurisdiction under the Federal Power Act, which

prohibits the payment of dividends out of capital accounts; payment of dividends is allowed out of retained earnings only.

NSP-Minnesota’s first mortgage indenture places certain restrictions on the amount of cash dividends it can pay to Xcel Energy

Inc., the holder of its common stock. Even with these restrictions, NSP-Minnesota could have paid more than $1.1 billion in

additional cash dividends on common stock at Dec. 31, 2010, or $1.2 billion at Dec. 31, 2011.

NSP-Minnesota’s state regulatory commissions indirectly limit the amount of dividends NSP-Minnesota can pay to Xcel Energy

Inc. by requiring an equity-to-total capitalization ratio between 47.07 percent and 57.53 percent. NSP-Minnesota’s equity-to-total

capitalization ratio was 52.1 percent at Dec. 31, 2011. Total capitalization for NSP-Minnesota cannot exceed $8.25 billion.

NSP-Wisconsin shall not pay dividends if its calendar year average equity-to-total capitalization ratio is or falls below the state

commission authorized level of 52.5 percent. NSP-Wisconsin’s calendar year average equity-to-total capitalization ratio was 55.1

percent at Dec. 31, 2011.

SPS’ state regulatory commissions indirectly limit the amount of dividends that SPS can pay Xcel Energy Inc. by requiring an

equity-to-total capitalization ratio (excluding short-term debt) between 45.0 percent and 55.0 percent. In addition, SPS may not

pay a dividend that would cause it to lose its investment grade bond rating. SPS’ equity-to-total capitalization ratio (excluding

short-term debt) was 52.0 percent at Dec. 31, 2011.

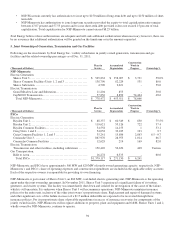

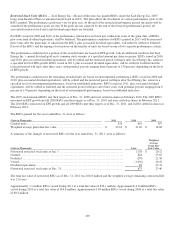

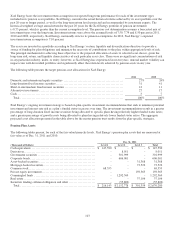

The issuance of securities by Xcel Energy Inc. generally is not subject to regulatory approval. However, utility financings and

certain intra-system financings are subject to the jurisdiction of the applicable state regulatory commissions and/or the FERC

under the Federal Power Act.

• PSCo currently has authorization to issue up to $1.15 billion of long-term debt and up to $800 million of short-term debt.

• SPS currently has authorization to issue up $400 million of short-term debt.