Xcel Energy 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

Commercial Paper — Xcel Energy Inc. and its utility subsidiaries meet their short-term liquidity requirements primarily through

the issuance of commercial paper and borrowings under their credit facilities. Commercial paper outstanding for Xcel Energy was

as follows:

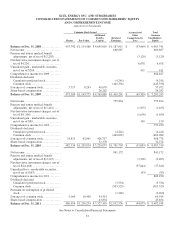

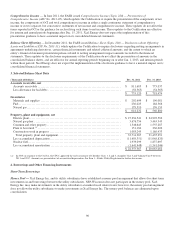

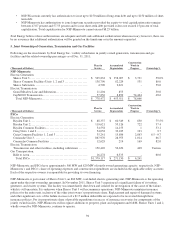

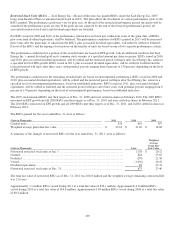

(Amounts in Millions, Except Interest Rates)

Three Months

Ended

Dec. 31, 2011

Borrowing limit .................................................... $

2,450

Amount outstanding at period end.................................... 219

Average amount outstanding ........................................ 165

Maximum amount outstanding....................................... 241

Weighted average interest rate, computed on a daily basis.............. 0.35%

Weighted average interest rate at end of period........................ 0.40

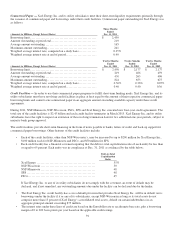

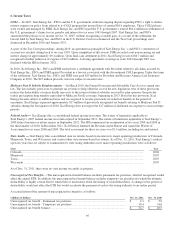

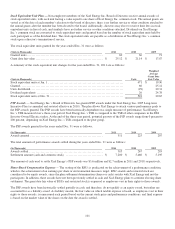

(Amounts in Millions, Except Interest Rates)

Twelve Months

Ended

Dec. 31, 2011

Twelve Months

Ended

Dec. 31, 2010

Twelve Months

Ended

Dec. 31, 2009

Borrowing limit .................................................... $

2,450 $

2,177 $

2,177

Amount outstanding at period end.................................... 219 466 459

Average amount outstanding ........................................ 430 263 406

Maximum amount outstanding....................................... 824 653 675

Weighted average interest rate, computed on a daily basis.............. 0.36% 0.36% 0.95

%

Weighted average interest rate at end of period........................ 0.40 0.40 0.36

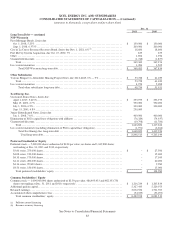

Credit Facilities — In order to use their commercial paper programs to fulfill short-term funding needs, Xcel Energy Inc. and its

utility subsidiaries must have revolving credit facilities in place at least equal to the amount of their respective commercial paper

borrowing limits and cannot issue commercial paper in an aggregate amount exceeding available capacity under these credit

agreements.

During 2011, NSP-Minnesota, NSP-Wisconsin, PSCo, SPS and Xcel Energy Inc. executed new four-year credit agreements. The

total size of the credit facilities is $2.45 billion and each credit facility terminates in March 2015. Xcel Energy Inc. and its utility

subsidiaries have the right to request an extension of the revolving termination date for two additional one-year periods, subject to

majority bank group approval.

The credit facilities provide short-term financing in the form of notes payable to banks, letters of credit and back-up support for

commercial paper borrowings. Other features of the credit facilities include:

• Each of the credit facilities, other than NSP-Wisconsin’s, may be increased by up to $200 million for Xcel Energy Inc.,

$100 million each for NSP-Minnesota and PSCo, and $50 million for SPS.

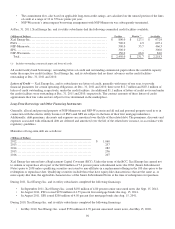

• Each credit facility has a financial covenant requiring that the debt-to-total capitalization ratio of each entity be less than

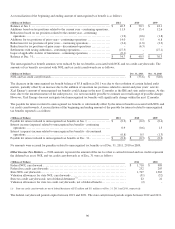

or equal to 65 percent. Each entity was in compliance at Dec. 31, 2011 as evidenced by the table below:

Debt-to-Total

Capitalization

Ratio

Xcel Energy ................................

..............

55

%

NSP-Wisconsin ................................

...........

50

NSP-Minnesota ................................

...........

48

SPS ................................

......................

48

PSCo................................

.....................

45

If Xcel Energy Inc. or any of its utility subsidiaries do not comply with the covenant, an event of default may be

declared, and if not remedied, any outstanding amounts due under the facility can be declared due by the lender.

• The Xcel Energy Inc. credit facility has a cross-default provision that provides Xcel Energy Inc. will be in default on its

borrowings under the facility if it or any of its subsidiaries, except NSP-Wisconsin as long as its total assets do not

comprise more than 15 percent of Xcel Energy’s consolidated total assets, default on certain indebtedness in an

aggregate principal amount exceeding $75 million.

• The interest rates under these lines of credit are based on the Eurodollar rate or an alternate base rate, plus a borrowing

margin of 0 to 200 basis points per year based on the applicable credit ratings.