Xcel Energy 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

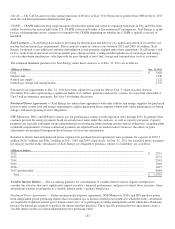

115

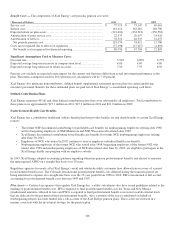

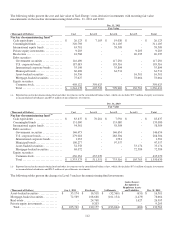

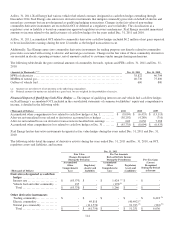

Dec. 31, 2010

Fair Value

Changes Recognized

During the Period in:

Pre-Tax Amounts

Reclassified into Income

During the Period from:

(Thousands of Dollars)

Accumulated

Other

Comprehensive

Loss

Regulatory

(Assets) and

Liabilities

Accumulated

Other

Comprehensive

Loss

Regulatory

Assets and

(Liabilities)

Pre-Tax Gains

Recognized

During the Period

in Income

Derivatives designated as cash

flow hedges

Interest rate

....................

$

(7,210

) $

- $

1,107 (a) $

- $

-

Vehicle fuel and other

commodity

...................

(238

) - 3,474 (e) - -

Total

..........................

$

(7,448

) $

- $

4,581 $

- $

-

Other derivative instruments

Trading commodity

.............

$

-

$

- $

- $

- $

11,004 (b)

Electric commodity

.............

-

3,969 - (21,840) (c)

-

Natural gas commodity

.........

-

(105,396) - 51,034 (d) -

Other

..........................

-

- - - 135 (b)

Total

..........................

$

-

$

(101,427) $

- $

29,194 $

11,139

(a) Recorded to interest charges.

(b) Recorded to electric operating revenues. Portions of these total gains and losses are subject to sharing with electric customers through margin-sharing

mechanisms and deducted from gross revenue, as appropriate.

(c) Recorded to electric fuel and purchased power. These derivative settlement gains and losses are shared with electric customers through fuel and purchased

energy cost-recovery mechanisms, and reclassified out of income as regulatory assets or liabilities, as appropriate.

(d) Recorded to cost of natural gas sold and transported. These derivative settlement gains and losses are shared with natural gas customers through purchased

natural gas cost-recovery mechanisms, and reclassified out of income as regulatory assets or liabilities, as appropriate.

(e) Recorded to O&M expenses.

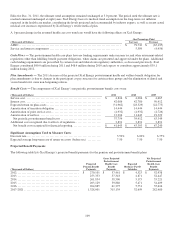

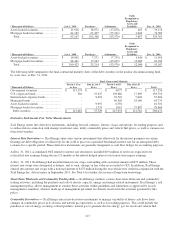

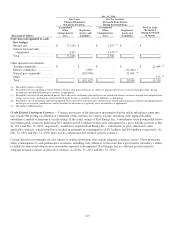

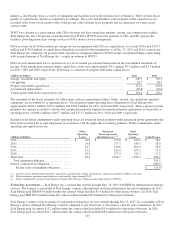

Credit Related Contingent Features — Contract provisions of the derivative instruments that the utility subsidiaries enter into

may require the posting of collateral or settlement of the contracts for various reasons, including if the applicable utility

subsidiary is unable to maintain its credit ratings. If the credit ratings of Xcel Energy Inc.’s subsidiaries were downgraded below

investment grade, contracts underlying $8.3 million and $5.6 million of derivative instruments in a gross liability position at Dec.

31, 2011 and Dec. 31, 2010, respectively, would have required Xcel Energy Inc.’s subsidiaries to post collateral or settle

applicable contracts, which would have resulted in payments to counterparties of $9.3 million and $9.8 million, respectively. At

Dec. 31, 2011 and Dec. 31, 2010, there was no collateral posted on these specific contracts.

Certain derivative instruments are also subject to contract provisions that contain adequate assurance clauses. These provisions

allow counterparties to seek performance assurance, including cash collateral, in the event that a given utility subsidiary’s ability

to fulfill its contractual obligations is reasonably expected to be impaired. Xcel Energy had no collateral posted related to

adequate assurance clauses in derivative contracts as of Dec. 31, 2011 and Dec. 31, 2010.