Xcel Energy 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

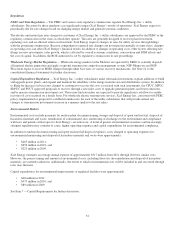

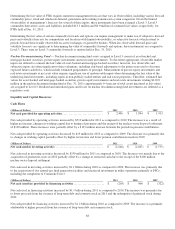

As of Dec. 31, 2011 and 2010, Xcel Energy has recorded regulatory assets of $2.8 billion and $2.5 billion and regulatory

liabilities of $1.4 billion and $1.3 billion, respectively. Each subsidiary is subject to regulation that varies from jurisdiction to

jurisdiction. If future recovery of costs, in any such jurisdiction, ceases to be probable, Xcel Energy would be required to charge

these assets to current net income or OCI. While there are no current or expected proposals or changes in the regulatory

environment that impact the probability of future recovery of these assets, if the SEC should mandate the use of IFRS the lack of

an accounting standard for rate-regulated entities under IFRS could require us to charge certain regulatory assets and regulatory

liabilities to net income or OCI. See Note 15 to the consolidated financial statements for further discussion of regulatory assets

and liabilities.

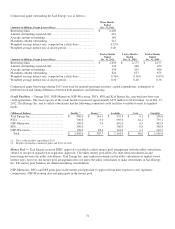

Income Tax Accruals

Judgment, uncertainty, and estimates are a significant aspect of the income tax accrual process that accounts for the effects of

current and deferred income taxes. Uncertainty associated with the application of tax statutes and regulations and the outcomes of

tax audits and appeals require that judgment and estimates be made in the accrual process and in the calculation of the ETR.

ETRs are also highly impacted by assumptions. ETR calculations are revised every quarter based on best available year end tax

assumptions (income levels, deductions, credits, etc.) by legal entity; adjusted in the following year after returns are filed, with the

tax accrual estimates being trued-up to the actual amounts claimed on the tax returns; and further adjusted after examinations by

taxing authorities have been completed.

In accordance with the interim reporting guidance, a tax expense or benefit is recorded every quarter to eliminate the difference in

continuing operations tax expense computed based on the actual year-to-date ETR and the forecasted annual ETR.

Accounting for income taxes also requires that only tax benefits that meet the more likely than not recognition threshold can be

recognized or continue to be recognized. The change in the unrecognized tax benefits needs to be reasonably estimated based on

evaluation of the nature of uncertainty, the nature of event that could cause the change and an estimated range of reasonably

possible changes. At any period end, and as new developments occur, management will use prudent business judgment to

derecognize appropriate amounts of tax benefits. Unrecognized tax benefits can be recognized as issues are favorably resolved

and loss exposures decline.

As disputes with the IRS and state tax authorities are resolved over time, we may need to adjust our unrecognized tax benefits and

interest accruals to the updated estimates needed to satisfy tax and interest obligations for the related issues. These adjustments

may be favorable or unfavorable, increasing or decreasing earnings. See Note 6 to the consolidated financial statements for

further discussion.

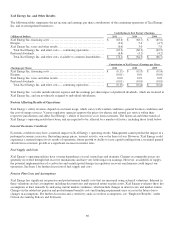

Employee Benefits

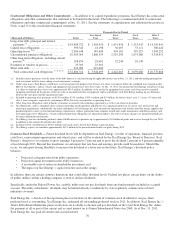

Xcel Energy’s pension costs are based on an actuarial calculation that includes a number of key assumptions, most notably the

annual return level that pension investment assets will earn in the future and the interest rate used to discount future pension

benefit payments to a present value obligation for financial reporting. In addition, the actuarial calculation uses an asset-

smoothing methodology to reduce the volatility of varying investment performance over time. See Note 9 to the consolidated

financial statements for further discussion on the rate of return and discount rate used in the calculation of pension costs and

obligations.

Pension costs and funding requirements are expected to increase in the next few years. While investment returns exceeded the

assumed levels from 2009-2011, investment returns in 2007 and 2008 were significantly below the assumed levels. The pension

cost calculation uses a market-related valuation of pension assets. Xcel Energy uses a calculated value method to determine the

market-related value of the plan assets. The market-related value is determined by adjusting the fair market value of assets at the

beginning of the year to reflect the investment gains and losses (the difference between the actual investment return and the

expected investment return on the market-related value) during each of the previous five years at the rate of 20 percent per year.

As these differences between the actual investment returns and the expected investment returns are incorporated into the market-

related value, the differences are recognized over the expected average remaining years of service for active employees.

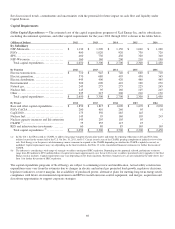

Based on current assumptions and the recognition of past investment gains and losses, Xcel Energy currently projects that the

pension costs recognized for financial reporting purposes will increase from an expense of $47.8 million in 2010 and an expense

of $81.0 million in 2011 to an expense of $124.1 million in 2012 and expense of $138.1 million in 2013. The expected increase in

the 2012 expense is due to the continued phase in of unrecognized plan losses primarily resulting from the market decline in

2008.