Xcel Energy 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

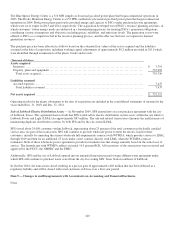

The Blue Spruce Energy Center is a 310 MW simple cycle natural gas-fired power plant that began commercial operations in

2003. The Rocky Mountain Energy Center is a 652 MW combined-cycle natural gas-fired power plant that began commercial

operations in 2004. Both power plants previously provided energy and capacity to PSCo under purchased power agreements,

which were set to expire in 2013 and 2014, respectively. The acquisition developed out of PSCo’s resource planning activities, in

which customers’ future energy needs are addressed in a formal planning process for meeting PSCo’s generation obligations,

considering various assumptions and objectives including prices, reliability, and emissions levels. The generation assets were

offered to PSCo as a competitive bid in the resource planning process, and the offer was the least cost option for thermal

generation resources.

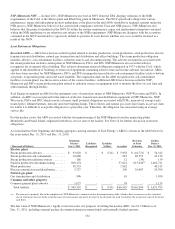

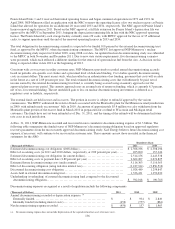

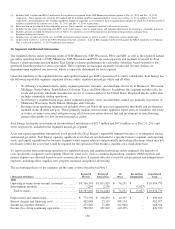

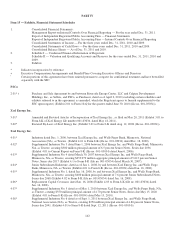

The purchase price has been allocated as follows based on the estimated fair values of the assets acquired and the liabilities

assumed at the date of acquisition, including working capital adjustments of approximately $0.2 million recorded in 2011 which

were identified through examination of the plants’ books and records:

(Thousands of Dollars)

Assets acquired

Inventory ................................................................

..............................

$

3,791

Property, plant and equipment ................................................................

...........

735,959

Total assets acquired................................................................

..................

739,750

Liabilities assumed

Accrued expenses ................................................................

......................

7,437

Total liabilities assumed................................................................

...............

7,437

Net assets acquired ................................................................

......................

$

732,313

Operating results for the plants subsequent to the date of acquisition are included in the consolidated statements of income for the

years ended Dec. 31, 2010 and Dec. 31, 2011.

Sale of Lubbock Electric Distribution Assets — In November 2009, SPS entered into an asset purchase agreement with the city

of Lubbock, Texas. This agreement had set forth that SPS would sell its electric distribution system assets within the city limits to

Lubbock Power and Light (LP&L) for approximately $87 million. The sale and related transactions eliminate the inefficiencies of

maintaining duplicate distribution systems, by both SPS and by the city-owned LP&L.

SPS served about 24,000 customers within Lubbock, representing about 25 percent of the total customers in the dually certified

service area. As part of this transaction, SPS will continue to provide wholesale power to meet the electric load for these

customers, initially by amending the current wholesale full-requirements contract with WTMPA, which provides service to LP&L

through 2019 and then for an additional 25 years under a new contract directly with LP&L when the WTMPA contract

terminates. Both of these wholesale power agreements provide for formula rates that change annually based on the actual cost of

service. The formula rate with WTMPA reflects an initial 10.5 percent ROE. All or portions of this transaction were reviewed and

approved by the PUCT, the NMPRC and the FERC.

Additionally, SPS and the city of Lubbock entered into an amended long-term treated sewage effluent water agreement under

which SPS will continue to purchase waste water from the city for cooling SPS’ Jones Station southeast of Lubbock.

In October 2010, the transaction closed resulting in a pre-tax gain of approximately $20 million that has been deferred as a

regulatory liability and will be shared with retail customers in Texas over a four year period.

Item 9 — Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.