Xcel Energy 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

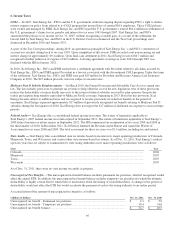

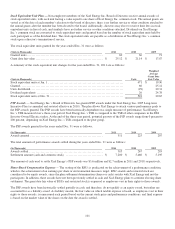

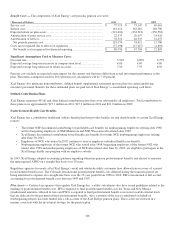

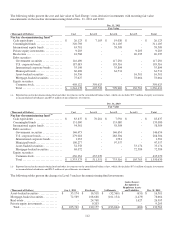

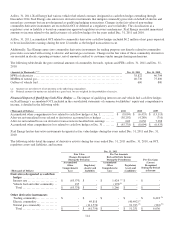

(Thousands of Dollars) 2011 2010

Change in Fair Value of Plan Assets:

Fair value of plan assets at Jan. 1................................

..........................

$

2,540,708 $

2,449,326

Actual return on plan assets ................................

..............................

230,401 282,688

Employer contributions ................................................................

..

137,344 34,132

Benefit payments ................................................................

........

(238,173) (225,438)

Fair value of plan assets at Dec. 31 ................................

........................

$

2,670,280 $

2,540,708

Funded Status of Plans at Dec. 31:

Funded status (a) ................................................................

.........

$

(555,939) $

(489,584)

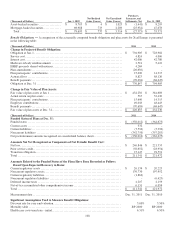

Amounts Not Yet Recognized as Components of Net Periodic Benefit Cost:

Net loss................................................................

.................

$

1,610,946 $

1,502,888

Prior service cost ................................................................

........

18,432 40,965

Total ................................................................

...................

$

1,629,378 $

1,543,853

Amounts Related to the Funded Status of the Plans Have Been Recorded as Follows

Based Upon Expected Recovery in Rates:

Current regulatory assets ................................

................................

$

123,814 $

92,765

Noncurrent regulatory assets................................

..............................

1,435,372 1,386,125

Deferred income taxes ................................................................

...

28,759 26,592

Net-of-tax accumulated other comprehensive income ................................

.......

41,433 38,371

Total ................................................................

...................

$

1,629,378 $

1,543,853

Measurement date ................................................................

.......

Dec. 31, 2011

Dec. 31, 2010

Significant Assumptions Used to Measure Benefit Obligations:

Discount rate for year-end valuation................................

.......................

5.00%

5.50%

Expected average long-term increase in compensation level

................................

4.00 4.00

Mortality table ................................................................

..........

RP 2000 RP 2000

(a) Amounts are recognized in noncurrent liabilities on Xcel Energy’s consolidated balance sheet.

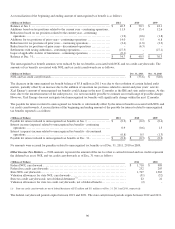

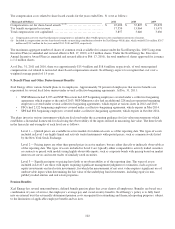

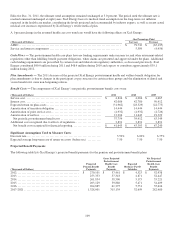

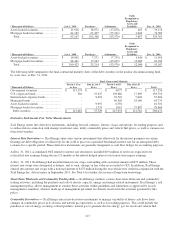

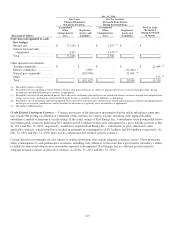

Cash Flows — Cash funding requirements can be impacted by changes to actuarial assumptions, actual asset levels and other

calculations prescribed by the funding requirements of income tax and other pension-related regulations. These regulations did

not require cash funding for 2008 through 2010 for Xcel Energy’s pension plans. Required contributions were made in 2011 and

2012 to meet minimum funding requirements.

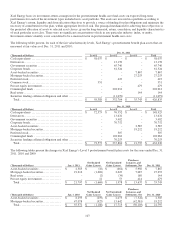

The Pension Protection Act changed the minimum funding requirements for defined benefit pension plans beginning in 2008. The

following are the pension funding contributions, both voluntary and required, made by Xcel Energy for 2010 through 2012:

• In January 2012, contributions of $190.5 million were made across four of Xcel Energy’s pension plans;

• In 2011, contributions of $137.3 million were made across three of Xcel Energy’s pension plans;

• In 2010, contributions of $34 million were made to the Xcel Energy Pension Plan.

• For future years, we anticipate contributions will be made as necessary.

Plan Amendments — No amendments occurred during 2011 to the Xcel Energy pension plans.