Xcel Energy 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

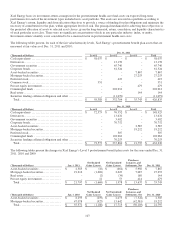

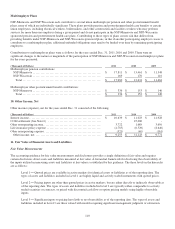

Xcel Energy bases its investment-return assumption for the postretirement health care fund assets on expected long-term

performance for each of the investment types included in its asset portfolio. The assets are invested in a portfolio according to

Xcel Energy’s return, liquidity and diversification objectives to provide a source of funding for plan obligations and minimize the

necessity of contributions to the plan, within appropriate levels of risk. The principal mechanism for achieving these objectives is

the projected allocation of assets to selected asset classes, given the long-term risk, return, correlation, and liquidity characteristics

of each particular asset class. There were no significant concentrations of risk in any particular industry, index, or entity.

Investment-return volatility is not considered to be a material factor in postretirement health care costs.

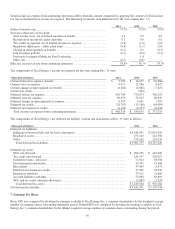

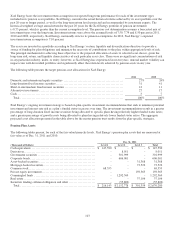

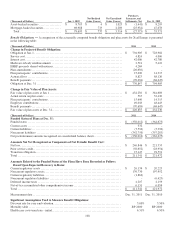

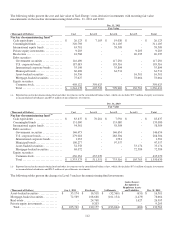

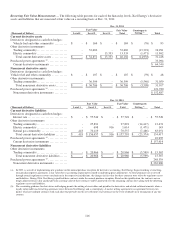

The following tables present, for each of the fair value hierarchy levels, Xcel Energy’s postretirement benefit plan assets that are

measured at fair value as of Dec. 31, 2011 and 2010:

Dec. 31, 2011

(Thousands of Dollars) Level 1 Level 2 Level 3 Total

Cash equivalents ................................

........

$

58,037 $

- $

- $

58,037

Derivatives................................

..............

- 13,178 - 13,178

Government securities ................................

...

- 65,746 - 65,746

Corporate bonds................................

.........

- 61,524 - 61,524

Asset-backed securities ................................

..

- - 7,867 7,867

Mortgage-backed securities

...............................

- - 27,253 27,253

Preferred stock ................................

..........

- 423 - 423

Common stock ................................

..........

351 - - 351

Private equity investments

................................

- - 479 479

Commingled funds ................................

......

- 202,912 - 202,912

Real estate ................................

..............

- - 144 144

Securities lending collateral obligation and other

...........

- (11,079) - (11,079)

Total ................................

.................

$

58,388 $

332,704 $

35,743 $

426,835

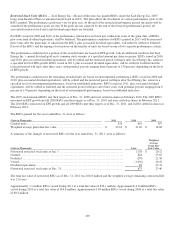

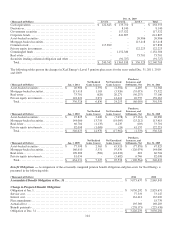

Dec. 31, 2010

(Thousands of Dollars) Level 1 Level 2 Level 3 Total

Cash equivalents ................................

........

$

72,573 $

76,352 $

- $

148,925

Derivatives................................

..............

- 13,632 - 13,632

Government securities ................................

...

- 3,402 - 3,402

Corporate bonds................................

.........

- 70,752 - 70,752

Asset-backed securities ................................

..

- - 2,585 2,585

Mortgage-backed securities

...............................

- - 19,212 19,212

Preferred stock ................................

..........

- 507 - 507

Commingled funds ................................

......

- 102,962 - 102,962

Securities lending collateral obligation and other

...........

- 70,253 - 70,253

Total ................................

.................

$

72,573 $

337,860 $

21,797 $

432,230

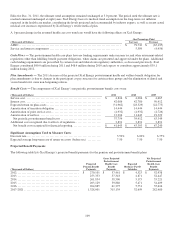

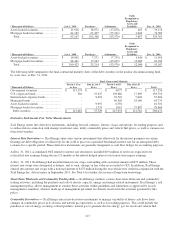

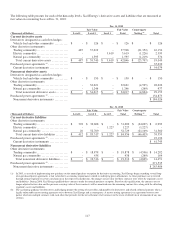

The following tables present the changes in Xcel Energy’s Level 3 postretirement benefit plan assets for the years ended Dec. 31,

2011, 2010 and 2009:

(Thousands of Dollars) Jan. 1, 2011

Net Realized

Gains (Losses)

Net Unrealized

Gains (Losses)

Purchases,

Issuances, and

Settlements, Net

Dec. 31, 2011

Asset-backed securities .................

$

2,585 $

(10) $

(664) $

5,956 $

7,867

Mortgage-backed securities..............

19,212 (1,669) 2,623 7,087 27,253

Real estate .............................

- (2) (34) 180 144

Private equity investments...............

- 12 53 414 479

Total ................................

$

21,797 $

(1,669) $

1,978 $

13,637 $

35,743

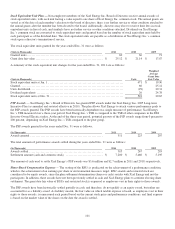

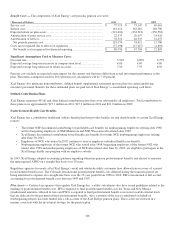

(Thousands of Dollars) Jan. 1, 2010

Net Realized

Gains (Losses)

Net Unrealized

Gains (Losses)

Purchases,

Issuances, and

Settlements, Net

Dec. 31, 2010

Asset-backed securities .................

$

8,293 $

(259) $

2,073 $

(7,522) $

2,585

Mortgage-backed securities..............

47,078 (927) 15,642 (42,581) 19,212

Total ................................

$

55,371 $

(1,186) $

17,715 $

(50,103) $

21,797