Xcel Energy 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

Xcel Energy’s operations are subject to air, water, and particulate matter state laws and regulations. These laws and regulations

regulate air emissions from various sources, including electrical generating units, and impose certain monitoring and reporting

requirements. Such laws and regulations may require Xcel Energy to obtain pre-approval for the construction or modification of

certain projects that increase air emissions, obtain and strictly comply with air permits that contain emission and operational

limitations or mandate the installation and operation of expensive pollution control equipment at facilities. Xcel Energy will likely

be required to incur capital expenditures in the future to comply with these requirements for remediation plans of MGP sites and

various regulations for air emissions and water intake. Actual expenditures could be higher or lower than the estimates presented,

and the scope and timing of these expenditures cannot be fully determined until any new or revised regulations become final.

In July 2011, the EPA issued the CSAPR, to address long-range transport of particulate matter and ozone by requiring reductions

in SO2 and NOx from utilities located in the eastern half of the U.S. On Dec. 30, 2011, the D.C. Circuit issued a stay of the

CSAPR, pending completion of judicial review of the rule. The states in which Xcel Energy operates are currently considering

SIPs which may be superseded by CAIR and/or CSAPR. Xcel Energy is in the process of determining various scenarios to

respond to the CSAPR uncertainty.

In addition, there are emission controls, known as BART, for industrial facilities emitting air pollutants that reduce visibility in

certain national parks and wilderness areas throughout the U.S. Xcel Energy generating facilities in several states will be subject

to BART requirements.

Further, generating facilities throughout the Xcel Energy territory are subject to mercury reduction requirements at the state level.

In December 2011, the EPA adopted a regulation setting national emission limits for electric generating units for mercury, certain

metals, and acid gas emissions.

See Note 13 to the consolidated financial statements for further discussion of Xcel Energy’s environmental contingencies.

Inflation

Inflation at its current level is not expected to materially affect Xcel Energy’s prices or returns to shareholders. However,

potential future inflation resulting from the economic and monetary stimulus policies of the U.S. Government and the Federal

Reserve could lead to future price increases for materials and services required to deliver electric and natural gas services to

customers. These potential cost increases could in turn lead to increased prices to customers.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

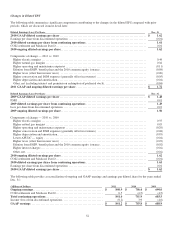

Preparation of the consolidated financial statements and related disclosures in compliance with GAAP requires the application of

accounting rules and guidance, as well as the use of estimates. The application of these policies necessarily involves judgments

regarding future events, including the likelihood of success of particular projects, legal and regulatory challenges and anticipated

recovery of costs. These judgments could materially impact the consolidated financial statements and disclosures, based on

varying assumptions. In addition, the financial and operating environment may have a significant effect on the operation of our

business and on the results reported even if the nature of the accounting policies applied have not changed. The following is a list

of accounting policies that are most critical to the portrayal of Xcel Energy’s financial condition and results, and that require

management’s most difficult, subjective or complex judgments. Each of these has a higher potential likelihood of resulting in

materially different reported amounts under different conditions or using different assumptions. Each critical accounting policy

has been discussed with the Audit Committee of the Xcel Energy Inc.’s Board of Directors.

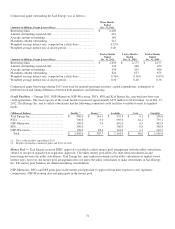

Regulatory Accounting

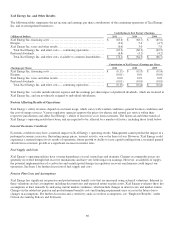

Xcel Energy Inc. is a holding company with rate-regulated subsidiaries that are subject to the accounting for Regulated

Operations, which provides that rate-regulated entities account for and report assets and liabilities consistent with the recovery of

those incurred costs in rates, if the rates established are designed to recover the costs of providing the regulated service and if the

competitive environment makes it probable that such rates will be charged and collected. Xcel Energy’s rates are derived through

the ratemaking process, which results in the recording of regulatory assets and liabilities based on the probability of future cash

flows. Regulatory assets represent incurred or accrued costs that have been deferred because they are probable of future recovery

from customers. Regulatory liabilities represent amounts that are expected to be refunded to customers in future rates or amounts

collected in current rates for future costs. In other businesses or industries, regulatory assets and regulatory liabilities would

generally be charged to net income or OCI.