XM Radio 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

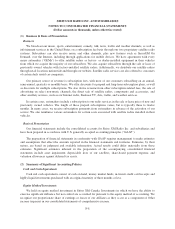

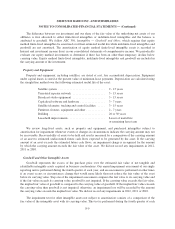

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

year, and an assessment is performed at other times if events or circumstances indicate it is more likely than not

that the asset is impaired. Our indefinite life intangibles include our FCC licenses and trademark. If the carrying

value of the intangible asset exceeds its fair value, an impairment loss is recognized in an amount equal to that

excess.

ASU 2012-02, Testing Indefinite-Lived Intangible Assets for Impairment, established an option to first

perform a qualitative assessment to determine whether it is more likely than not that an asset is impaired. If the

qualitative assessment supports that it is more likely than not that the fair value of the asset exceeds its carrying

value, a quantitative impairment test is not required. If the qualitative assessment does not support the fair value

of the asset, then a quantitative assessment is performed. We completed a qualitative assessment during the

fourth quarter of 2012 and determined that there was no impairment in 2012. We used independent appraisals to

determine the fair value of our FCC licenses and trademark using the Income and the Relief from Royalty

approaches, respectively, in 2011 and 2010 and no impairments were recorded.

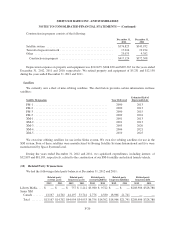

Other intangible assets with finite lives consists primarily of customer relationships acquired in business

combinations, licensing agreements, and certain information technology related costs. These assets are amortized

over their respective estimated useful lives to their estimated residual values, and reviewed for impairment under

the provisions of ASC 360-10-35, Property, Plant and Equipment/Overall/Subsequent Measurement. We review

intangible assets subject to amortization for impairment whenever events or circumstances indicate that the

carrying amount of an asset may not be recoverable. If the sum of the expected cash flows, undiscounted and

without interest, is less than the carrying amount of the asset, an impairment loss is recognized as the amount by

which the carrying amount of the asset exceeds its fair value. We did not record any impairments relating to our

intangible assets with finite lives in 2012, 2011 or 2010.

Revenue Recognition

We derive revenue primarily from subscribers, advertising and direct sales of merchandise.

Revenue from subscribers consists of subscription fees, daily rental fleet revenue and non-refundable

activation and other fees. Revenue is recognized as it is realized or realizable and earned. We recognize

subscription fees as our services are provided. At the time of sale, vehicle owners purchasing or leasing a vehicle

with a subscription to our service typically receive between a three and twelve month prepaid subscription.

Prepaid subscription fees received from certain automakers are recorded as deferred revenue and amortized to

revenue ratably over the service period which commences upon retail sale and activation.

We recognize revenue from the sale of advertising as the advertising is broadcast. Agency fees are

calculated based on a stated percentage applied to gross billing revenue for our advertising inventory and are

reported as a reduction of advertising revenue. We pay certain third parties a percentage of advertising revenue.

Advertising revenue is recorded gross of such revenue share payments as we are the primary obligor in the

transaction. Advertising revenue share payments are recorded to Revenue share and royalties during the period in

which the advertising is broadcast.

Equipment revenue and royalties from the sale of satellite radios, components and accessories are

recognized upon shipment, net of discounts and rebates. Shipping and handling costs billed to customers are

recorded as revenue. Shipping and handling costs associated with shipping goods to customers are reported as a

component of Cost of equipment.

ASC 605, Revenue Recognition, provides guidance on how and when to recognize revenues for

arrangements that may involve the delivery or performance of multiple products, services and/or rights to use

assets. Revenue arrangements with multiple deliverables are required to be divided into separate units of

F-10