XM Radio 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

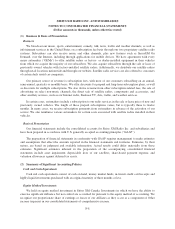

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

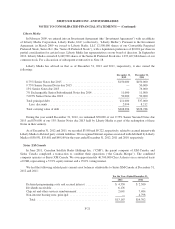

Accumulated Other Comprehensive Income

Accumulated other comprehensive income of $120 at December 31, 2012 was primarily comprised of

foreign currency translation adjustments related to our interest in Sirius XM Canada. During the years ended

December 31, 2012, 2011 and 2010, we recorded a foreign currency translation adjustment of $49, $(140) and

$251, respectively, which is recorded net of taxes of $48, $11 and $63, respectively. In addition, during the year

ended December 31, 2011, we recorded a loss on our XM Canada investment foreign currency translation

adjustment of $6,072. During the year ended December 31, 2010, we recorded an unrealized gain on available-

for-sale securities of $469.

Recent Accounting Pronouncements

In May 2011, the FASB issued ASU 2011-04, Amendments to Achieve Common Fair Value Measurement

and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (Topic 820) —

Fair Value Measurement, to provide a consistent definition of fair value and ensure that the fair value

measurement and disclosure requirements are similar between U.S. GAAP and International Financial Reporting

Standards. ASU 2011-04 changes certain fair value measurement principles and enhances the disclosure

requirements particularly for Level 3 fair value measurements. This standard is effective for interim and annual

periods beginning after December 15, 2011 and is applied on a prospective basis. We adopted ASU 2011-04 as

of January 1, 2012 and the impact was not material to our consolidated financial statements.

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220), Presentation of

Comprehensive Income, to require an entity to present the total of comprehensive income, the components of net

income, and the components of other comprehensive income either in single continuous statement of

comprehensive income or in two separate but consecutive statements. ASU 2011-05 eliminates the option to

present the components of other comprehensive income as part of the statement of equity. The standard does not

change the items which must be reported in other comprehensive income, how such items are measured or when

they must be reclassified to net income. This standard is effective for interim and annual periods beginning after

December 15, 2011 and is to be applied retrospectively. The FASB has deferred the requirement to present

reclassification adjustments for each component of accumulated other comprehensive income in both net income

and other comprehensive income. Companies are required to either present amounts reclassified out of other

comprehensive income on the face of the financial statements or disclose those amounts in the notes to the

financial statements. During the deferral period, there is no requirement to separately present or disclose the

reclassification adjustments into net income. The effective date of this deferral was consistent with the effective

date of ASU 2011-05. We adopted ASU 2011-05 as of January 1, 2012 and disclosed comprehensive income in

our consolidated statements of comprehensive income. ASU 2011-05 affects financial statement presentation and

has no impact on our results of consolidated financial statements.

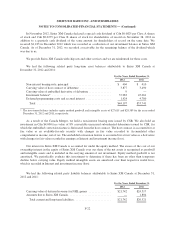

In July 2012, the FASB issued ASU 2012-02, Testing Indefinite-Lived Intangible Assets for Impairment.

The guidance gives companies the option to first perform a qualitative assessment to determine whether it is

more likely than not that an indefinite-lived intangible asset is impaired. If the qualitative assessment supports

that it is more likely than not the fair value of the asset exceeds its carrying amount, the company would not be

required to perform a quantitative impairment test. If the qualitative assessment does not support the fair value of

the asset, then a quantitative assessment is performed. ASU 2012-02 is effective for public entities for annual and

interim impairment tests performed for fiscal years beginning after September 15, 2012. We early adopted ASU

2012-02 and performed a qualitative assessment to determine whether our indefinite-lived intangible assets were

impaired as of the fourth quarter of 2012.

F-14