XM Radio 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

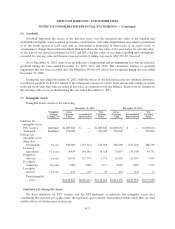

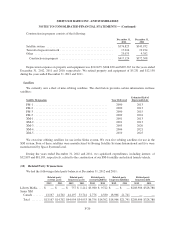

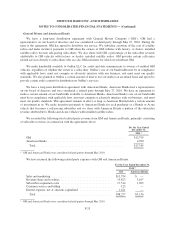

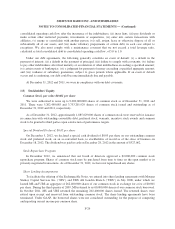

We recorded the following revenue from Sirius Canada. Royalty income is included in Other revenue and

dividend income is included in Interest and investment income (loss) in our consolidated statements of

comprehensive income:

For the Years Ended December 31,

2011 * 2010

Royalty income ............................................ $ 9,945 $10,684

Dividend income ........................................... 460 926

Total revenue from Sirius Canada ............................ $10,405 $11,610

* Sirius Canada combined with XM Canada in June 2011.

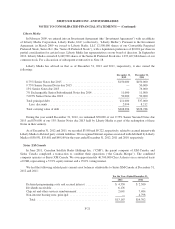

Receivables from royalty and dividend income were utilized to absorb a portion of our share of net losses

generated by Sirius Canada. Total costs reimbursed by Sirius Canada were $5,253 and $12,185 for the years

ended December 31, 2011 and 2010, respectively.

Our share of net earnings or losses of Sirius Canada was recorded to Interest and investment income (loss)

in our consolidated statements of comprehensive income on a one month lag. Our share of Sirius Canada’s net

loss was $9,717 and $10,257 for the years ended December 31, 2011 and 2010, respectively. The payments

received from Sirius Canada in excess of carrying value were $6,748 and $10,281 for the years ended

December 31, 2011 and 2010, respectively.

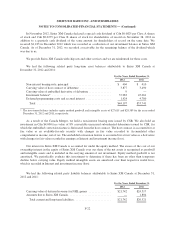

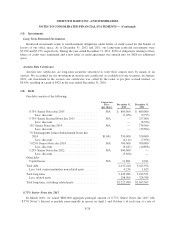

XM Canada

We had an equity interest of 21.5% in XM Canada until June 21, 2011 when the Canada Merger closed.

The Cdn $45,000 standby credit facility we extended to XM Canada was paid and terminated as a result of

the Canada Merger. We received $38,815 in cash upon payment of this facility. As a result of the repayment of

the credit facility and completion of the Canada Merger, we released a $15,649 valuation allowance related to the

absorption of our share of the net loss from our investment in XM Canada as of June 21, 2011.

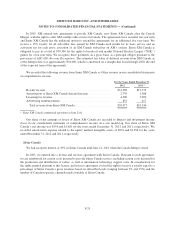

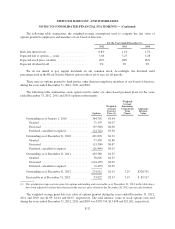

We recorded the following revenue from XM Canada as Other revenue in our consolidated statements of

comprehensive income:

For the Years Ended December 31,

2011 * 2010

Amortization of XM Canada deferred income .................... $ 1,388 $ 2,776

Subscriber and activation fee royalties .......................... 5,483 10,313

Licensing fee revenue ....................................... 3,000 4,500

Advertising reimbursements .................................. 833 1,083

Total revenue from XM Canada ............................. $10,704 $18,672

* XM Canada combined with Sirius Canada in June 2011.

Our share of net earnings or losses of XM Canada was recorded to Interest and investment income (loss) in

our consolidated statements of comprehensive income on a one month lag. Our share of XM Canada’s net loss

was $6,045 and $12,147 for the years ended December 31, 2011 and 2010, respectively.

F-24