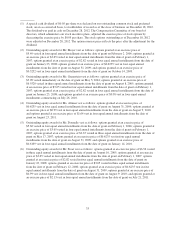

XM Radio 2012 Annual Report Download - page 47

Download and view the complete annual report

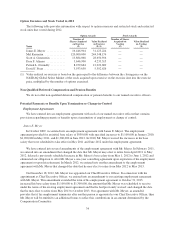

Please find page 47 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2003 Long-Term Stock Incentive Plan

Messrs. Meyer, Greenstein, Donnelly and Frear also have outstanding options as of December 31, 2012 that

were granted under the 2003 Long-Term Stock Incentive Plan. Under the 2003 Long-Term Stock Incentive Plan,

the outstanding equity awards granted to these named executive officers are subject to potential accelerated

vesting upon a change of control. In addition, Mr. Frear’s award agreements relating to options and restricted

stock units granted to him in February 2008 under the 2003 plan provide that such equity awards are subject to

potential accelerated vesting upon his death and disability. All of the outstanding options granted under the 2003

plan were vested as of December 31, 2012, and, therefore, are not included in the table of potential payments and

benefits below.

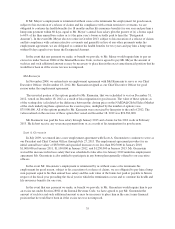

2009 Long-Term Stock Incentive Plan

All of our named executive officers have outstanding equity awards as of December 31, 2012 that were

granted under the 2009 Long-Term Stock Incentive Plan. Under the terms of the 2009 plan, the outstanding

equity awards granted to the named executive officers are subject to potential accelerated vesting upon

termination without cause by the company or termination by the executive for good reason during a two year

period following a change of control, to the extent outstanding awards granted under the plan are either assumed,

converted or replaced by the resulting entity in the event of a change of control.

37