XM Radio 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of December 31, 2012, we have a valuation allowance of $9,835 which relates to deferred tax assets that

are not likely due to certain state net operating loss limitations.

Recent Accounting Pronouncements

Information regarding accounting pronouncements is included in Note 2 to the consolidated financial

statements.

Glossary

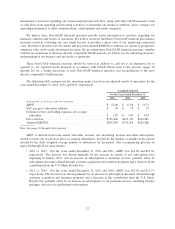

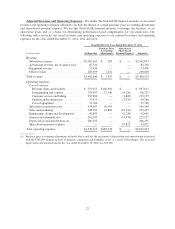

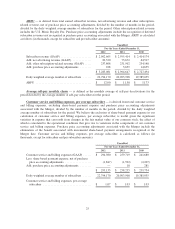

Adjusted EBITDA – EBITDA is defined as net income before interest and investment income (loss);

interest expense, net of amounts capitalized; income tax expense and depreciation and amortization. We adjust

EBITDA to remove the impact of other income and expense, loss on extinguishment of debt as well as certain

other charges discussed below. This measure is one of the primary Non-GAAP financial measures on which we

(i) evaluate the performance of our businesses, (ii) base our internal budgets and (iii) compensate management.

Adjusted EBITDA is a Non-GAAP financial performance measure that excludes (if applicable): (i) certain

adjustments as a result of the purchase price accounting for the Merger, (ii) goodwill impairment,

(iii) restructuring, impairments, and related costs, (iv) depreciation and amortization and (v) share-based payment

expense. The purchase price accounting adjustments include: (i) the elimination of deferred revenue associated

with the investment in XM Canada, (ii) recognition of deferred subscriber revenues not recognized in purchase

price accounting, and (iii) elimination of the benefit of deferred credits on executory contracts, which are

primarily attributable to third party arrangements with an OEM and programming providers. We believe adjusted

EBITDA is a useful measure of the underlying trend of our operating performance, which provides useful

information about our business apart from the costs associated with our physical plant, capital structure and

purchase price accounting. We believe investors find this Non-GAAP financial measure useful when analyzing

our results and comparing our operating performance to the performance of other communications, entertainment

and media companies. We believe investors use current and projected adjusted EBITDA to estimate our current

and prospective enterprise value and to make investment decisions. Because we fund and build-out our satellite

radio system through the periodic raising and expenditure of large amounts of capital, our results of operations

reflect significant charges for depreciation expense. The exclusion of depreciation and amortization expense is

useful given significant variation in depreciation and amortization expense that can result from the potential

variations in estimated useful lives, all of which can vary widely across different industries or among companies

within the same industry. We believe the exclusion of restructuring, impairments and related costs is useful given

the nature of these expenses. We also believe the exclusion of share-based payment expense is useful given the

significant variation in expense that can result from changes in the fair value as determined using the Black-

Scholes-Merton model which varies based on assumptions used for the expected life, expected stock price

volatility and risk-free interest rates.

20