XM Radio 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

We do not have any other significant off-balance sheet financing arrangements that are reasonably likely to have a

material effect on our financial condition, results of operations, liquidity, capital expenditures or capital resources.

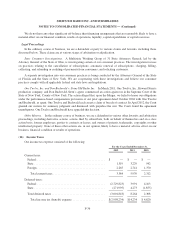

Legal Proceedings

In the ordinary course of business, we are a defendant or party to various claims and lawsuits, including those

discussed below. These claims are at various stages of arbitration or adjudication.

State Consumer Investigations. A Multistate Working Group of 31 State Attorneys General, led by the

Attorney General of the State of Ohio, is investigating certain of our consumer practices. The investigation focuses

on practices relating to the cancellation of subscriptions; automatic renewal of subscriptions; charging, billing,

collecting, and refunding or crediting of payments from consumers; and soliciting customers.

A separate investigation into our consumer practices is being conducted by the Attorneys General of the State

of Florida and the State of New York. We are cooperating with these investigations and believe our consumer

practices comply with all applicable federal and state laws and regulations.

One Twelve, Inc. and Don Buchwald v. Sirius XM Radio Inc. In March 2011, One Twelve, Inc., Howard Stern’s

production company, and Don Buchwald, Stern’s agent, commenced an action against us in the Supreme Court of the

State of New York, County of New York. The action alleged that, upon the Merger, we failed to honor our obligations

under the performance-based compensation provisions of our prior agreement dated October 2004 with One Twelve

and Buchwald, as agent; One Twelve and Buchwald each assert a claim of breach of contract. In April 2012, the Court

granted our motion for summary judgment and dismissed with prejudice the suit. The Court found the agreement

unambiguous. One Twelve and Buchwald have appealed this decision.

Other Matters. In the ordinary course of business, we are a defendant in various other lawsuits and arbitration

proceedings, including derivative actions; actions filed by subscribers, both on behalf of themselves and on a class

action basis; former employees; parties to contracts or leases; and owners of patents, trademarks, copyrights or other

intellectual property. None of these other actions are, in our opinion, likely to have a material adverse effect on our

business, financial condition or results of operations.

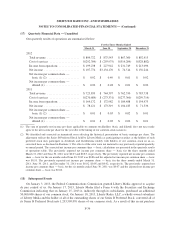

(16) Income Taxes

Our income tax expense consisted of the following:

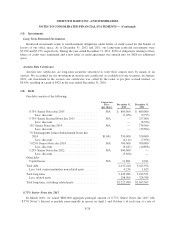

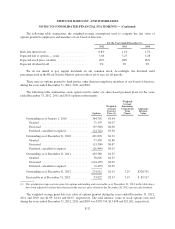

For the Years Ended December 31,

2012 2011 2010

Current taxes:

Federal .............................................. $ — $ — $ —

State ................................................ 1,319 3,229 942

Foreign .............................................. 2,265 2,741 1,370

Total current taxes ................................... 3,584 5,970 2,312

Deferred taxes:

Federal .............................................. (2,729,823) 3,991 4,163

State ................................................ (271,995) 4,273 (1,855)

Total deferred taxes .................................... (3,001,818) 8,264 2,308

Total income tax (benefit) expense ...................... $(2,998,234) $14,234 $ 4,620

F-36