XM Radio 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

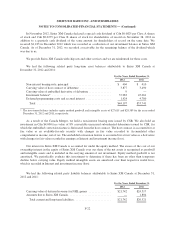

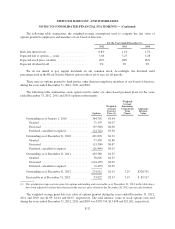

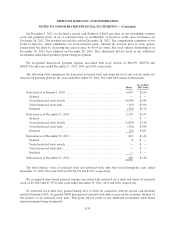

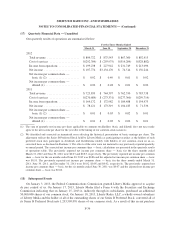

The following table summarizes the weighted-average assumptions used to compute the fair value of

options granted to employees and members of our board of directors:

For the Years Ended December 31,

2012 2011 2010

Risk-free interest rate ........................... 0.8% 1.1% 1.7%

Expected life of options — years ................. 5.06 5.27 5.28

Expected stock price volatility ................... 49% 68% 85%

Expected dividend yield ........................ 0% 0% 0%

We do not intend to pay regular dividends on our common stock. Accordingly, the dividend yield

percentage used in the Black-Scholes-Merton option value is set to zero for all periods.

There were no options granted to third parties, other than non-employee members of our board of directors,

during the years ended December 31, 2012, 2011 and 2010.

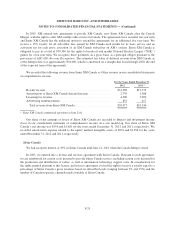

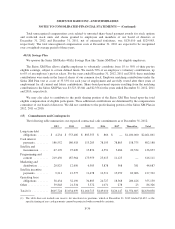

The following table summarizes stock option activity under our share-based payment plans for the years

ended December 31, 2012, 2011 and 2010 (options in thousands):

Options

Weighted-

Average

Exercise

Price (1)

Weighted-

Average

Remaining

Contractual

Term

(Years)

Aggregate

Intrinsic

Value

Outstanding as of January 1, 2010 ............. 364,792 $1.44

Granted ................................ 71,179 $0.97

Exercised ............................... (19,360) $0.56

Forfeited, cancelled or expired .............. (14,741) $3.58

Outstanding as of December 31, 2010 .......... 401,870 $1.32

Granted ................................ 77,450 $1.80

Exercised ............................... (13,300) $0.87

Forfeited, cancelled or expired .............. (26,440) $4.15

Outstanding as of December 31, 2011 .......... 439,580 $1.25

Granted ................................ 58,626 $2.53

Exercised ............................... (214,199) $0.59

Forfeited, cancelled or expired .............. (9,495) $3.09

Outstanding as of December 31, 2012 .......... 274,512 $1.92 7.29 $320,751

Exercisable as of December 31, 2012 ........... 93,822 $2.53 5.19 $ 89,517

(1) The weighted-average exercise price for options outstanding and exercisable as of December 31, 2012 in the table above

have been adjusted to reflect the reduction to the exercise price related to the December 28, 2012 special cash dividend.

The weighted average grant date fair value of options granted during the years ended December 31, 2012,

2011 and 2010 was $1.09, $1.04 and $0.67, respectively. The total intrinsic value of stock options exercised

during the years ended December 31, 2012, 2011 and 2010 was $399,794, $13,408 and $13,261, respectively.

F-32