XM Radio 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

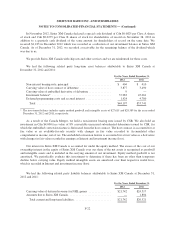

8.75% per annum. The 8.75% Notes mature on April 1, 2015. The 8.75% Notes were issued for $786,000,

resulting in an aggregate original issuance discount of $14,000. Substantially all of our domestic wholly-owned

subsidiaries guarantee our obligations under the 8.75% Notes on a senior unsecured basis.

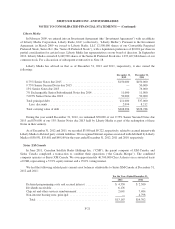

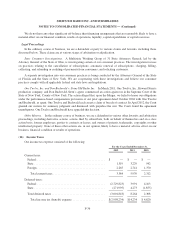

7% Exchangeable Senior Subordinated Notes due 2014

In August 2008, we issued $550,000 aggregate principal amount of 7% Exchangeable Senior Subordinated

Notes due 2014 (the “Exchangeable Notes”). The Exchangeable Notes are senior subordinated obligations and

rank junior in right of payment to our existing and future senior debt and equally in right of payment with our

existing and future senior subordinated debt. Substantially all of our domestic wholly-owned subsidiaries have

guaranteed the Exchangeable Notes on a senior subordinated basis.

Interest is payable semi-annually in arrears on June 1 and December 1 of each year at a rate of 7% per

annum. The Exchangeable Notes mature on December 1, 2014. The Exchangeable Notes are exchangeable at any

time at the option of the holder into shares of our common stock at an initial exchange rate of 533.3333 shares of

common stock per $1,000 principal amount of Exchangeable Notes, which is equivalent to an approximate

exchange price of $1.875 per share of common stock. If a holder of the Exchangeable Notes elects to exchange

the notes in connection with a corporate transaction that constitutes a fundamental change, the exchange rate will

be increased by an additional number of shares of common stock determined by the Indenture. Due to the special

cash dividend in December 2012, the conversion rate increased to 543.1372 shares per common stock per $1,000

principal amount. For a discussion of subsequent events refer to Note 18.

During the year ended December 31, 2012, the common stock reserved for exchange in connection with the

Exchangeable Notes were considered to be dilutive in our calculation of diluted net income per share.

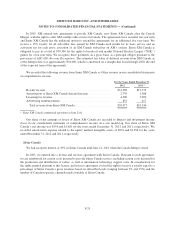

7.625% Senior Notes due 2018

In October 2010, we issued $700,000 aggregate principal amount of 7.625% Senior Notes due 2018 (the

“7.625% Notes”). Interest is payable semi-annually in arrears on May 1 and November 1 of each year at a rate of

7.625% per annum. The 7.625% Notes mature on November 1, 2018. Substantially all of our domestic wholly-

owned subsidiaries guarantee our obligations under the 7.625% Notes.

5.25% Senior Notes due 2022

In August 2012, we issued $400,000 aggregate principal amount of 5.25% Senior Notes due 2022 (the

“5.25% Notes”). Interest is payable semi-annually in arrears on February 15 and August 15 of each year at a rate

of 5.25% per annum. The 5.25% Notes mature on August 15, 2022. Substantially all of our domestic wholly-

owned subsidiaries guarantee our obligations under the 5.25% Notes.

Senior Secured Revolving Credit Facility

In December 2012, we entered into a five-year Senior Secured Revolving Credit Facility (the “Credit

Facility”) with a syndicate of financial institutions for $1,250,000. The Credit Facility is secured by substantially

all our assets and the assets of our subsidiaries. The proceeds of loans under the Credit Facility will be used for

working capital and other general corporate purposes, including financing acquisitions, share repurchases and

dividends. Interest on borrowings is payable on a quarterly basis and accrues at a rate based on LIBOR plus an

applicable rate. We are also required to pay a variable fee on the average daily unused portion of the Credit

Facility which is currently 0.30% per annum and is payable on a quarterly basis. The Credit Facility contains

customary covenants, including a maintenance covenant.

As of December 31, 2012, we have not drawn on the Credit Facility.

F-27