XM Radio 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

consolidated operating cash flow after the incurrence of the indebtedness, (ii) incur liens, (iii) pay dividends or

make certain other restricted payments, investments or acquisitions, (iv) enter into certain transactions with

affiliates, (v) merge or consolidate with another person, (vi) sell, assign, lease or otherwise dispose of all or

substantially all of our assets, and (vii) make voluntary prepayments of certain debt, in each case subject to

exceptions. We also must comply with a maintenance covenant that we not exceed a total leverage ratio,

calculated as total consolidated debt to consolidated operating cash flow, of 5.0 to 1.0.

Under our debt agreements, the following generally constitute an event of default: (i) a default in the

payment of interest; (ii) a default in the payment of principal; (iii) failure to comply with covenants; (iv) failure

to pay other indebtedness after final maturity or acceleration of other indebtedness exceeding a specified amount;

(v) certain events of bankruptcy; (vi) a judgment for payment of money exceeding a specified aggregate amount;

and (vii) voidance of subsidiary guarantees, subject to grace periods where applicable. If an event of default

occurs and is continuing, our debt could become immediately due and payable.

At December 31, 2012 and 2011, we were in compliance with our debt covenants.

(13) Stockholders’ Equity

Common Stock, par value $0.001 per share

We were authorized to issue up to 9,000,000,000 shares of common stock as of December 31, 2012 and

2011. There were 5,262,440,085 and 3,753,201,929 shares of common stock issued and outstanding as of

December 31, 2012 and 2011, respectively.

As of December 31, 2012, approximately 1,885,629,000 shares of common stock were reserved for issuance

in connection with outstanding convertible debt, preferred stock, warrants, incentive stock awards and common

stock to be granted to third parties upon satisfaction of performance targets.

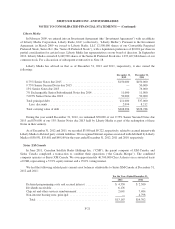

Special Dividend Declared, $0.05 per share

On December 5, 2012, we declared a special cash dividend of $0.05 per share on our outstanding common

stock and preferred stock, on an as-converted basis, to stockholders of record as of the close of business on

December 18, 2012. The dividend was paid in cash on December 28, 2012 in the amount of $327,062.

Stock Repurchase Program

In December 2012, we announced that our board of directors approved a $2,000,000 common stock

repurchase program. Shares of common stock may be purchased from time to time on the open market or in

privately negotiated transactions. As of December 31, 2012, we have not repurchased any shares.

Share Lending Arrangements

To facilitate the offering of the Exchangeable Notes, we entered into share lending agreements with Morgan

Stanley Capital Services Inc. (“MS”) and UBS AG London Branch (“UBS”) in July 2008, under which we

loaned MS and UBS an aggregate of 262,400,000 shares of our common stock in exchange for a fee of $0.001

per share. During the third quarter of 2009, MS returned to us 60,000,000 shares of our common stock borrowed.

In October 2011, MS and UBS returned the remaining 202,400,000 shares loaned. The returned shares were

retired upon receipt and removed from outstanding common stock. The share lending agreements have been

terminated. Under GAAP, the borrowed shares were not considered outstanding for the purpose of computing

and reporting our net income per common share.

F-29