XM Radio 2012 Annual Report Download - page 95

Download and view the complete annual report

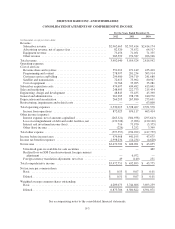

Please find page 95 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

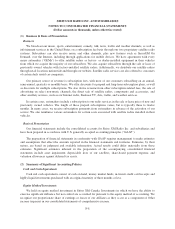

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The difference between our investment and our share of the fair value of the underlying net assets of our

affiliates is first allocated to either finite-lived intangibles or indefinite-lived intangibles and the balance is

attributed to goodwill. We follow ASC 350, Intangibles — Goodwill and Other, which requires that equity

method finite-lived intangibles be amortized over their estimated useful life while indefinite-lived intangibles and

goodwill are not amortized. The amortization of equity method finite-lived intangible assets is recorded in

Interest and investment income (loss) in our consolidated statements of comprehensive income. We periodically

evaluate our equity method investments to determine if there has been an other than temporary decline below

carrying value. Equity method finite-lived intangibles, indefinite-lived intangibles and goodwill are included in

the carrying amount of the investment.

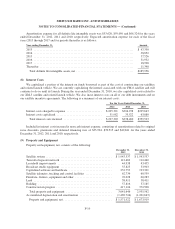

Property and Equipment

Property and equipment, including satellites, are stated at cost, less accumulated depreciation. Equipment

under capital leases is stated at the present value of minimum lease payments. Depreciation are calculated using

the straight-line method over the following estimated useful life of the asset:

Satellite system ................................ 2-15years

Terrestrial repeater network ...................... 5-15years

Broadcast studio equipment ...................... 3-15years

Capitalized software and hardware ................. 3-7years

Satellite telemetry, tracking and control facilities ..... 3-15years

Furniture, fixtures, equipment and other ............. 2-7years

Building ...................................... 20or30years

Leasehold improvements ......................... Lesser of useful life

or remaining lease term

We review long-lived assets, such as property and equipment, and purchased intangibles subject to

amortization for impairment whenever events or changes in circumstances indicate the carrying amount may not

be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount

of an asset to estimated undiscounted future cash flows expected to be generated by the asset. If the carrying

amount of an asset exceeds the estimated future cash flows, an impairment charge is recognized for the amount

by which the carrying amount exceeds the fair value of the asset. We did not record any impairments in 2012,

2011 or 2010.

Goodwill and Other Intangible Assets

Goodwill represents the excess of the purchase price over the estimated fair value of net tangible and

identifiable intangible assets acquired in business combinations. Our annual impairment assessment of our single

reporting unit is performed during the fourth quarter of each year, and an assessment is performed at other times

if an event occurs or circumstances change that would more likely than not reduce the fair value of the asset

below its carrying value. Step one of the impairment assessment compares the fair value to its carrying value and

if the fair value exceeds its carrying value, goodwill is not impaired. If the carrying value exceeds the fair value,

the implied fair value of goodwill is compared to the carrying value of goodwill. If the implied fair value exceeds

the carrying value then goodwill is not impaired; otherwise, an impairment loss will be recorded by the amount

the carrying value exceeds the implied fair value. We did not record any impairments in 2012, 2011 or 2010.

The impairment test for other intangible assets not subject to amortization consists of a comparison of the

fair value of the intangible asset with its carrying value. This test is performed during the fourth quarter of each

F-9