XM Radio 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

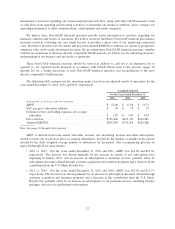

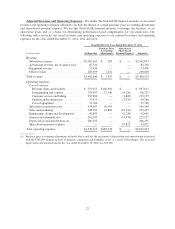

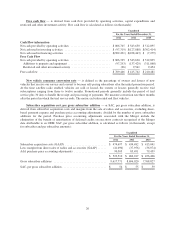

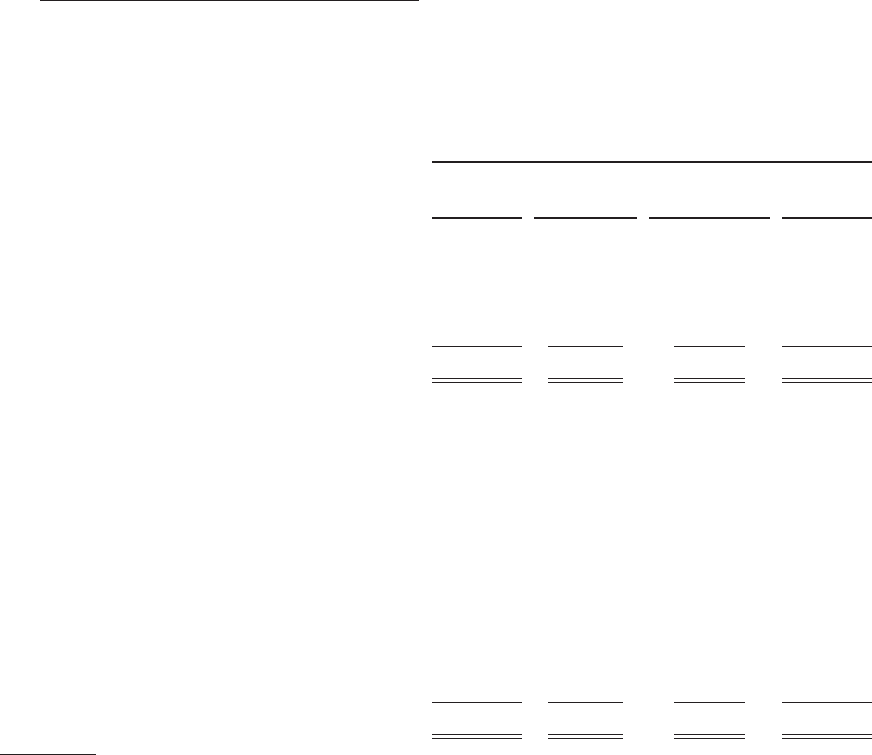

Adjusted Revenues and Operating Expenses – We define this Non-GAAP financial measure as our actual

revenues and operating expenses adjusted to exclude the impact of certain purchase price accounting adjustments

and share-based payment expense. We use this Non-GAAP financial measure to manage our business, to set

operational goals and as a basis for determining performance-based compensation for our employees. The

following tables reconcile our actual revenues and operating expenses to our adjusted revenues and operating

expenses for the years ended December 31, 2012, 2011 and 2010:

Unaudited For the Year Ended December 31, 2012

(in thousands) As Reported

Purchase Price

Accounting

Adjustments

Allocation of

Share-based

Payment Expense Adjusted

Revenue:

Subscriber revenue .................... $2,962,665 $ 228 $ — $2,962,893

Advertising revenue, net of agency fees .... 82,320 — — 82,320

Equipment revenue .................... 73,456 — — 73,456

Other revenue ........................ 283,599 7,251 — 290,850

Total revenue .......................... $3,402,040 $ 7,479 $ — $3,409,519

Operating expenses

Cost of services:

Revenue share and royalties ........... $ 551,012 $146,601 $ — $ 697,613

Programming and content ............. 278,997 37,346 (6,120) 310,223

Customer service and billing .......... 294,980 — (1,847) 293,133

Satellite and transmission ............. 72,615 — (3,329) 69,286

Cost of equipment ................... 31,766 — — 31,766

Subscriber acquisition costs ............. 474,697 90,503 — 565,200

Sales and marketing ................... 248,905 14,828 (10,310) 253,423

Engineering, design and development ..... 48,843 — (6,238) 42,605

General and administrative .............. 261,905 — (35,978) 225,927

Depreciation and amortization (a) ........ 266,295 — — 266,295

Share-based payment expense ........... — — 63,822 63,822

Total operating expenses ................. $2,530,015 $289,278 $ — $2,819,293

(a) Purchase price accounting adjustments included above exclude the incremental depreciation and amortization associated

with the $785,000 stepped up basis in property, equipment and intangible assets as a result of the Merger. The increased

depreciation and amortization for the year ended December 31, 2012 was $53,000.

22