XM Radio 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

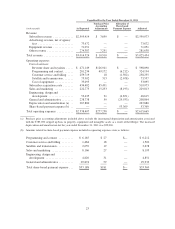

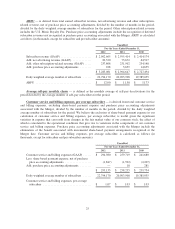

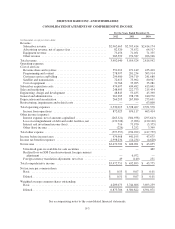

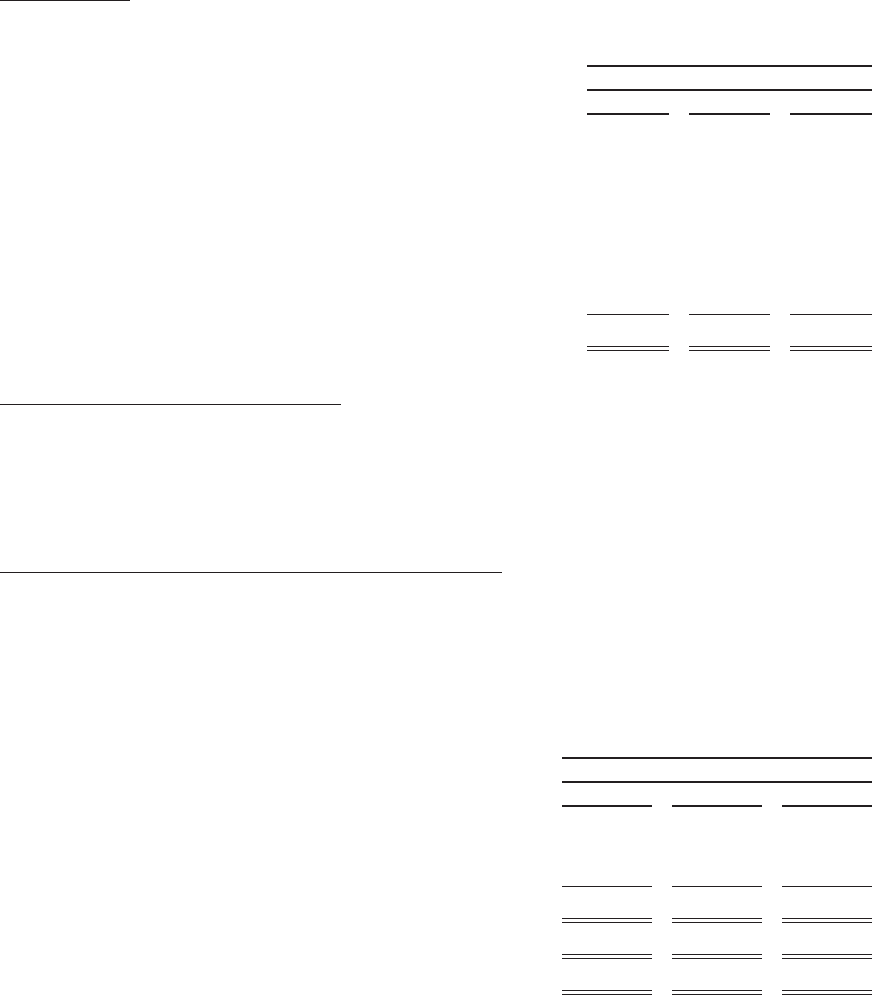

Free cash flow — is derived from cash flow provided by operating activities, capital expenditures and

restricted and other investment activity. Free cash flow is calculated as follows (in thousands):

Unaudited

For the Years Ended December 31,

2012 2011 2010

Cash Flow information

Net cash provided by operating activities ........................... $806,765 $ 543,630 $ 512,895

Net cash used in investing activities ............................... $ (97,319) $(127,888) $(302,414)

Net cash used in financing activities ............................... $(962,491) $(228,443) $ (7,279)

Free Cash Flow

Net cash provided by operating activities ........................... $806,765 $ 543,630 $ 512,895

Additions to property and equipment ............................. (97,293) (137,429) (311,868)

Restricted and other investment activity .......................... (26) 9,541 9,454

Free cash flow ................................................ $709,446 $ 415,742 $ 210,481

New vehicle consumer conversion rate — is defined as the percentage of owners and lessees of new

vehicles that receive our service and convert to become self-paying subscribers after the initial promotion period.

At the time satellite radio enabled vehicles are sold or leased, the owners or lessees generally receive trial

subscriptions ranging from three to twelve months. Promotional periods generally include the period of trial

service plus 30 days to handle the receipt and processing of payments. We measure conversion rate three months

after the period in which the trial service ends. The metric excludes rental and fleet vehicles.

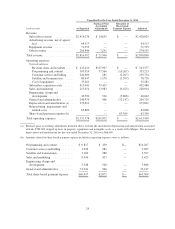

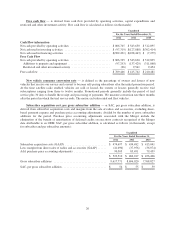

Subscriber acquisition cost, per gross subscriber addition — or SAC, per gross subscriber addition, is

derived from subscriber acquisition costs and margins from the sale of radios and accessories, excluding share-

based payment expense and purchase price accounting adjustments, divided by the number of gross subscriber

additions for the period. Purchase price accounting adjustments associated with the Merger include the

elimination of the benefit of amortization of deferred credits on executory contracts recognized at the Merger

date attributable to an OEM. SAC, per gross subscriber addition, is calculated as follows (in thousands, except

for subscriber and per subscriber amounts):

Unaudited

For the Years Ended December 31,

2012 2011 2010

Subscriber acquisition costs (GAAP) ............................ $ 474,697 $ 434,482 $ 413,041

Less: margin from direct sales of radios and accessories (GAAP) ...... (41,690) (37,956) (36,074)

Add: purchase price accounting adjustments ...................... 90,503 85,491 79,439

$ 523,510 $ 482,017 $ 456,406

Gross subscriber additions .................................... 9,617,771 8,696,020 7,768,827

SAC, per gross subscriber addition .............................. $ 54 $ 55 $ 59

26