XM Radio 2012 Annual Report Download - page 51

Download and view the complete annual report

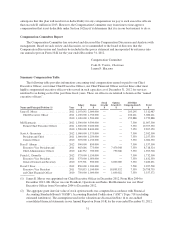

Please find page 51 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 3 — STOCKHOLDER PROPOSAL REGARDING SUCCESSION PLANNING

The Central Laborers’ Pension Fund, P.O. Box 1267, Jacksonville, Illinois 62651-1267, which is the owner

of approximately 28,300 shares of our common stock, has given notice that it intends to present the following

resolution for action at the annual meeting:

Resolved: That the shareholders of Sirius XM Radio, Inc. (“Company”) hereby request that the Board of

Directors initiate the appropriate process to amend the Company’s Corporate Governance Guidelines

(“Guidelines”) to adopt and disclose a written and detailed succession planning policy, including the following

specific features:

• The Board of Directors will review the plan annually;

• The Board will develop criteria for the CEO position which will reflect the Company’s business strategy

and will use a formal assessment process to evaluate candidates;

• The Board will identify and develop internal candidates;

• The Board will begin non-emergency CEO succession planning at least 3 years before an expected

transition and will maintain an emergency succession plan that is reviewed annually;

• The Board will annually produce a report on its succession plan to shareholders.

Supporting Statement:

CEO succession is one of the primary responsibilities of the board of directors. A recent study published by

the NACO quoted a director of a large technology firm: “A board’s biggest responsibility is succession planning.

It’s the one area where the board is completely accountable, and the choice has significant consequences, good

and bad, for the corporation’s future.” (The Role of the Board in CEO Succession: A Best Practices Study, 2006).

The study also cited research by Challenger, Gray & Christmas that “CEO departures doubled in 2005, with 1228

departures recorded from the beginning of 2005 through November, up 102 percent from the same period in

2004.”

In its 2007 study What Makes the Most Admired Companies Great: Board Governance and Effective

Human Capital Management, Hay Group found that 85% of the Most Admired Company boards have a well-

defined CEO succession plan to prepare for replacement of the CEO on a long-term basis and that 91% have a

well-defined plan to cover the emergency loss of the CEO that is discussed at least annually by the board.

The NACO report identified several best practices and innovations in CEO succession planning. The report

found that boards of companies with successful CEO transitions are more likely to have well-developed

succession plans that are put in place well before a transition, are focused on developing internal candidates and

include clear candidate criteria and a formal assessment process. Our proposal is intended to have the board

adopt a written policy containing several specific best practices in order to ensure a smooth transition in the event

of the CEO’s departure. We urge shareholders to vote FOR our proposal.

Board Recommendation

Our board of directors and the Nominating and Corporate Governance Committee have considered this

proposal and concluded that it is unnecessary and not in the best interests of our stockholders.

The board certainly agrees that one of its most important duties is to ensure that our company is prepared for

the planned or unplanned departure of our Chief Executive Officer and any other member of our executive

management team. This proposal is unnecessary, however, because our board members engage in discussions

about CEO and other executive management succession on an ongoing basis, and our current succession

41