XM Radio 2012 Annual Report Download - page 29

Download and view the complete annual report

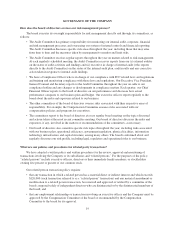

Please find page 29 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GOVERNANCE OF THE COMPANY

How does the board of directors oversee our risk management process?

The board executes its oversight responsibility for risk management directly and through its committees, as

follows:

• The Audit Committee has primary responsibility for monitoring our internal audit, corporate, financial

and risk management processes and overseeing our system of internal controls and financial reporting.

The Audit Committee discusses specific risk areas throughout the year, including those that may arise

from time to time and the measures taken by management to monitor and limit risks.

• The Audit Committee receives regular reports throughout the year on matters related to risk management.

At each regularly scheduled meeting, the Audit Committee receives reports from our (i) external auditor

on the status of audit activities and findings and (ii) executive in charge of internal audit (who reports

directly to the Audit Committee) on the status of the internal audit plan, audit results and any corrective

action taken in response to internal audit findings.

• We have a Compliance Officer who is in charge of our compliance with FCC related laws and regulations

and training and monitoring compliance with those laws and regulations. Our Executive Vice President,

General Counsel and Secretary reports to the Audit Committee throughout the year on calls to our

compliance hotline and any changes or developments in compliance matters. Each quarter, our Chief

Financial Officer reports to the board of directors on our performance and discusses how actual

performance compares to our business plan and budget. Our executive officers report regularly to the

board about the risks and exposures related to our business.

• The other committees of the board of directors oversee risks associated with their respective areas of

responsibility. For example, the Compensation Committee assesses risks associated with our

compensation policies and programs for executives.

• The committees report to the board of directors at every regular board meeting on the topics discussed

and actions taken at the most recent committee meeting. Our board of directors discusses the risks and

exposures, if any, involved in the matters or recommendations of the committees, as necessary.

• Our board of directors also considers specific risk topics throughout the year, including risks associated

with our business plan, operational efficiency, government regulation, physical facilities, information

technology infrastructure and capital structure, among many others. The board is informed about and

regularly discusses our risk profile, including legal, regulatory and operational risks to our business.

What are our policies and procedures for related party transactions?

We have adopted a written policy and written procedures for the review, approval and monitoring of

transactions involving the Company or its subsidiaries and “related persons.” For the purposes of the policy,

“related persons” include executive officers, directors or their immediate family members, or stockholders

owning five percent or greater of our common stock.

Our related person transaction policy requires:

• that any transaction in which a related person has a material direct or indirect interest and which exceeds

$120,000 (such transaction referred to as a “related person” transaction) and any material amendment or

modification to a related person transaction, be reviewed and approved or ratified by a committee of the

board composed solely of independent directors who are disinterested or by the disinterested members of

the board; and

• that any employment relationship or transaction involving an executive officer and the Company must be

approved by the Compensation Committee of the board or recommended by the Compensation

Committee to the board for its approval.

19