XM Radio 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

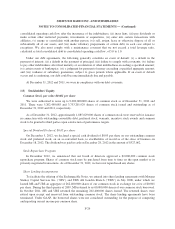

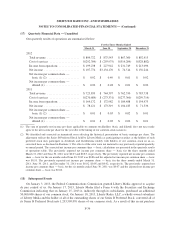

(17) Quarterly Financial Data — Unaudited

Our quarterly results of operations are summarized below:

For the Three Months Ended

March 31 June 30 September 30 December 31

2012

Total revenue ...................... $804,722 $ 837,543 $ 867,360 $ 892,415

Cost of services .................... $(292,309) $ (293,975) $(314,204) $(328,882)

Income from operations .............. $199,238 $ 227,942 $ 231,749 $ 213,096

Net income ........................ $107,774 $3,134,170 $ 74,514 $ 156,244

Net income per common share —

basic (1) (2) ..................... $ 0.02 $ 0.49 $ 0.01 $ 0.02

Net income per common share —

diluted (1) ....................... $ 0.02 $ 0.48 $ 0.01 $ 0.02

2011

Total revenue ...................... $723,839 $ 744,397 $ 762,550 $ 783,738

Cost of services .................... $(270,689) $ (273,331) $(277,360) $(299,719)

Income from operations .............. $164,172 $ 172,982 $ 184,488 $ 154,475

Net income ........................ $ 78,121 $ 173,319 $ 104,185 $ 71,336

Net income per common share —

basic (1) (2) ..................... $ 0.01 $ 0.03 $ 0.02 $ 0.01

Net income per common share —

diluted (1) ....................... $ 0.01 $ 0.03 $ 0.02 $ 0.01

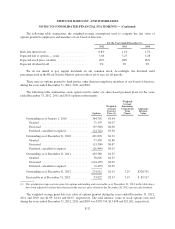

(1) The sum of quarterly net income per share applicable to common stockholders (basic and diluted) does not necessarily

agree to the net income per share for the year due to the timing of our common stock issuances.

(2) We identified and corrected an immaterial error affecting the historical presentation of basic earnings per share. The

adjustment reflects the Series B Preferred Stock held by Liberty Media as participating securities as the holders of such

preferred stock may participate in dividends and distributions ratably with holders of our common stock on an as-

converted basis as disclosed in Footnote 3. The effects of the error were not material to any previously reported quarterly

or annual period. The corrected net income per common share — basic calculations are presented in the quarterly results

of operations table. The previously reported net income per common share — basic for the three months ended

March 31, 2012 and June 30, 2012 were $0.03 and $0.83, respectively. The previously reported net income per common

share — basic for the six months ended June 30, 2012 was $0.86 and the adjusted net income per common share — basic

was $0.51. The previously reported net income per common share — basic for the three month ended March 31,

2011, June 30, 2011, and December 31, 2011 were $0.02, $0.05 and $0.02, respectively. The previously reported net

income per common share — basic for the six months ended June 30, 2011 was $0.07 and the adjusted net income per

common share — basic was $0.04.

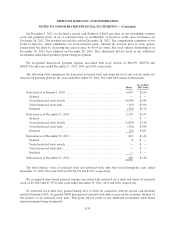

(18) Subsequent Events

On January 3, 2013, the Federal Communications Commission granted Liberty Media approval to acquire

de jure control of us. On January 17, 2013, Liberty Media filed a Form 4 with the Securities and Exchange

Commission indicating that on January 15, 2013 it, indirectly through its subsidiaries, purchased an additional

50,000,000 shares of our common stock. On January 18, 2013, Liberty Radio, LLC, a wholly-owned subsidiary

of Liberty Media and the holder of all of the outstanding shares of our Series B Preferred Stock, converted all of

its Series B Preferred Stock into 1,293,509,076 shares of our common stock. As a result of this recent purchase

F-39