XM Radio 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

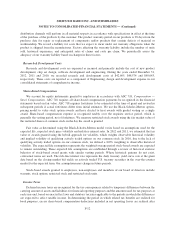

In November 2012, Sirius XM Canada declared a special cash dividend of Cdn $0.0825 per Class A shares

of stock and Cdn $0.0275 per Class B shares of stock for shareholders of record on November 28, 2012 in

addition to a quarterly cash dividend of the same amount for shareholders of record on the same date. We

received $1,185 in December 2012 which was recorded as a reduction of our investment balance in Sirius XM

Canada. As of December 31, 2012, we recorded a receivable for the remaining balance of the dividend which

was due to us.

We provide Sirius XM Canada with chip sets and other services and we are reimbursed for these costs.

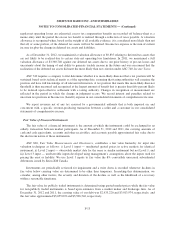

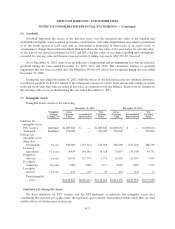

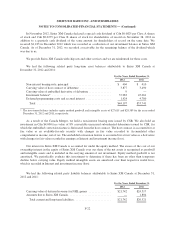

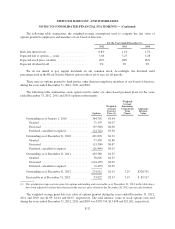

We had the following related party long-term asset balances attributable to Sirius XM Canada at

December 31, 2012 and 2011:

For the Years Ended December 31,

2012 2011

Non-interest bearing note, principal ............................ $ 404 $ 410

Carrying value of host contract of debenture ..................... 3,877 3,490

Carrying value of embedded derivative of debenture ............... 9 —

Investment balance* ........................................ 37,983 45,061

Deferred programming costs and accrued interest ................. 1,924 4,780

Total .................................................. $44,197 $53,741

* The investment balance includes equity method goodwill and intangible assets of $27,615 and $28,589 for the years ended

December 31, 2012 and 2011, respectively.

As a result of the Canada Merger, we hold a non-interest bearing note issued by CSR. We also hold an

investment in Cdn $4,000 face value of 8% convertible unsecured subordinated debentures issued by CSR, for

which the embedded conversion feature is bifurcated from the host contract. The host contract is accounted for at

fair value as an available-for-sale security with changes in fair value recorded to Accumulated other

comprehensive income, net of tax. The embedded conversion feature is accounted for at fair value as a derivative

with changes in fair value recorded in earnings as Interest and investment income (loss).

Our interest in Sirius XM Canada is accounted for under the equity method. The excess of the cost of our

ownership interest in the equity of Sirius XM Canada over our share of the net assets is recognized as goodwill

and intangible assets and is included in the carrying amount of our investment. Equity method goodwill is not

amortized. We periodically evaluate this investment to determine if there has been an other than temporary

decline below carrying value. Equity method intangible assets are amortized over their respective useful lives,

which is recorded in Interest and investment income (loss).

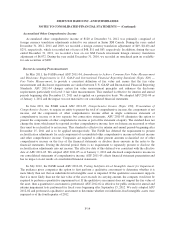

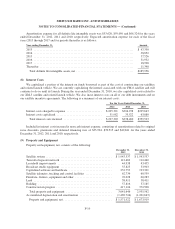

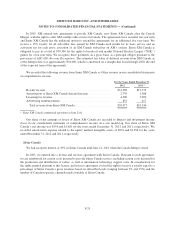

We had the following related party liability balances attributable to Sirius XM Canada at December 31,

2012 and 2011:

For the Years Ended December 31,

2012 2011

Carrying value of deferred revenue for NHL games ............... $21,742 $24,517

Amounts due to Sirius XM Canada ............................. — 1,804

Total current and long-term liabilities ......................... $21,742 $26,321

F-22