XM Radio 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

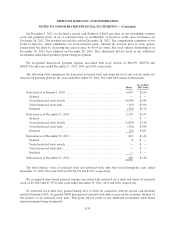

On December 5, 2012, we declared a special cash dividend of $0.05 per share on our outstanding common

stock and preferred stock, on an as-converted basis, to stockholders of record as of the close of business on

December 18, 2012. The dividend was paid in cash on December 28, 2012. The compensation committee of our

board of directors, which administers our stock incentive plans, adjusted the exercise price of stock options

issued under the plans by decreasing the exercise price by $0.05 per share. The stock options outstanding as of

December 18, 2012 were adjusted on December 28, 2012. This adjustment did not result in any additional

incremental share-based payment expense being recognized.

We recognized share-based payment expense associated with stock options of $60,299, $48,038 and

$44,833 for the years ended December 31, 2012, 2011 and 2010, respectively.

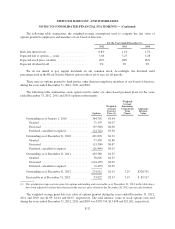

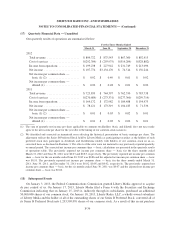

The following table summarizes the nonvested restricted stock and restricted stock unit activity under our

share-based payment plans for the years ended December 31, 2012, 2011 and 2010 (shares in thousands):

Shares

Grant Date

Fair Value

Nonvested as of January 1, 2010 ...................................... 6,919 $2.65

Granted ....................................................... — $ —

Vested restricted stock awards ..................................... (4,039) $2.85

Vested restricted stock units ....................................... (192) $2.92

Forfeited ...................................................... (291) $2.72

Nonvested as of December 31, 2010 ................................... 2,397 $2.57

Granted ....................................................... — $ —

Vested restricted stock awards ..................................... (1,854) $3.30

Vested restricted stock units ....................................... (101) $3.08

Forfeited ...................................................... (21) $3.05

Nonvested as of December 31, 2011 ................................... 421 $1.46

Granted ....................................................... 8 $ —

Vested restricted stock awards ..................................... — $ —

Vested restricted stock units ....................................... — $ —

Forfeited ...................................................... — $ —

Nonvested as of December 31, 2012 ................................... 429 $1.46

The total intrinsic value of restricted stock and restricted stock units that vested during the years ended

December 31, 2012, 2011 and 2010 was $0, $3,178 and $3,927, respectively.

We recognized share-based payment expense associated with restricted stock units and shares of restricted

stock of $0, $543 and $7,397 for the years ended December 31, 2012, 2011 and 2010, respectively.

No restricted stock units were granted during 2011 or 2010. In connection with the special cash dividend

paid in December 2012, we granted 8,000 incremental restricted stock units to prevent the economic dilution of

the holders of our restricted stock units. This grant did not result in any additional incremental share-based

payment expense being recognized.

F-33