XM Radio 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

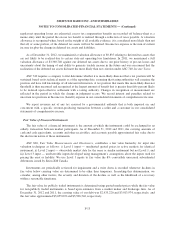

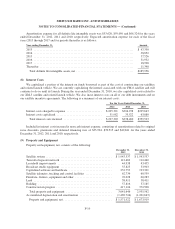

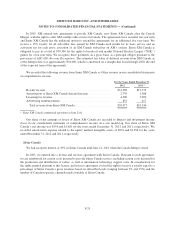

Amortization expense for all definite life intangible assets was $53,620, $59,050 and $66,324 for the years

ended December 31, 2012, 2011 and 2010, respectively. Expected amortization expense for each of the fiscal

years 2013 through 2017 and for periods thereafter is as follows:

Year ending December 31, Amount

2013 .................................................................... $ 47,330

2014 .................................................................... 38,852

2015 .................................................................... 37,526

2016 .................................................................... 31,932

2017 .................................................................... 18,968

Thereafter ................................................................ 11,348

Total definite life intangible assets, net ....................................... $185,956

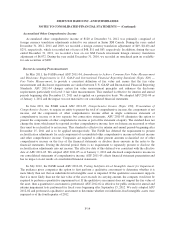

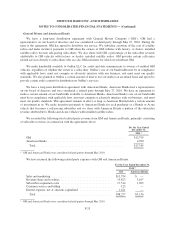

(8) Interest Costs

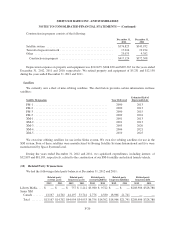

We capitalized a portion of the interest on funds borrowed as part of the cost of constructing our satellites

and related launch vehicle. We are currently capitalizing the interest associated with our FM-6 satellite and will

continue to do so until its launch. During the year ended December 31, 2010, we also capitalized costs related to

our XM-5 satellite and related launch vehicle. We also incur interest costs on all of our debt instruments and on

our satellite incentive agreements. The following is a summary of our interest costs:

For the Years Ended December 31,

2012 2011 2010

Interest costs charged to expense ........................ $265,321 $304,938 $295,643

Interest costs capitalized ............................... 31,982 33,522 63,880

Total interest costs incurred .......................... $297,303 $338,460 $359,523

Included in interest costs incurred is non-cash interest expense, consisting of amortization related to original

issue discounts, premiums and deferred financing fees of $35,924, $39,515 and $42,841 for the years ended

December 31, 2012, 2011 and 2010, respectively.

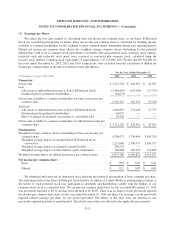

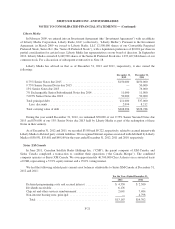

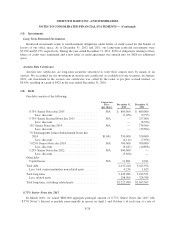

(9) Property and Equipment

Property and equipment, net, consists of the following:

December 31,

2012

December 31,

2011

Satellite system ............................................. $1,943,537 $ 1,943,537

Terrestrial repeater network ................................... 112,482 112,440

Leasehold improvements ..................................... 44,938 43,455

Broadcast studio equipment ................................... 55,823 53,903

Capitalized software and hardware ............................. 232,753 193,301

Satellite telemetry, tracking and control facilities .................. 62,734 60,539

Furniture, fixtures, equipment and other ......................... 76,028 60,283

Land ..................................................... 38,411 38,411

Building .................................................. 57,816 57,185

Construction in progress ...................................... 417,124 372,508

Total property and equipment ............................... 3,041,646 2,935,562

Accumulated depreciation and amortization ...................... (1,469,724) (1,261,643)

Property and equipment, net ................................. $1,571,922 $ 1,673,919

F-19