XM Radio 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

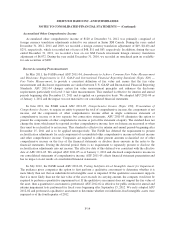

(3) Earnings per Share

We utilize the two-class method of calculating basic net income per common share, as our Series B Preferred

Stock are considered participating securities. Basic net income per common share is calculated by dividing income

available to common stockholders by the weighted average common shares outstanding during each reporting period.

Diluted net income per common share adjusts the weighted average common shares outstanding for the potential

dilution that could occur if common stock equivalents (convertible debt and preferred stock, warrants, stock options,

restricted stock and restricted stock units) were exercised or converted into common stock, calculated using the

treasury stock method. Common stock equivalents of approximately 147,125,000, 419,752,000 and 689,922,000 for

the years ended December 31, 2012, 2011 and 2010, respectively, were excluded from the calculation of diluted net

income per common share as the effect would have been anti-dilutive.

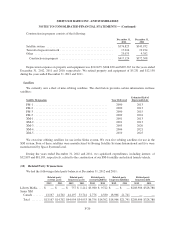

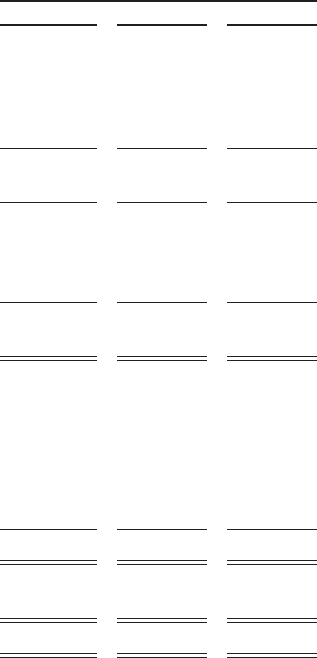

For the Years Ended December 31,

(in thousands, except per share data) 2012 2011 2010

Numerator:

Net income .................................................. $3,472,702 $ 426,961 $ 43,055

Less:

Allocation of undistributed income to Series B Preferred Stock ....... (1,084,895) (174,449) (17,735)

Dividends paid to preferred stockholders ......................... (64,675) — —

Net income available to common stockholders for basic net income per

common share .............................................. 2,323,132 252,512 25,320

Add back:

Allocation of undistributed income to Series B Preferred Stock ....... 1,084,895 174,449 17,735

Dividends paid to preferred stockholders ......................... 64,675 — —

Effect of interest on assumed conversions of convertible debt ........ 38,500 — —

Net income available to common stockholders for diluted net income per

common share .............................................. $3,511,202 $ 426,961 $ 43,055

Denominator:

Weighted average common shares outstanding for basic net income per

common share .............................................. 4,209,073 3,744,606 3,693,259

Weighted average impact of assumed Series B Preferred Stock

conversion ............................................... 2,215,900 2,586,977 2,586,977

Weighted average impact of assumed convertible debt .............. 298,725 — —

Weighted average impact of other dilutive equity instruments ........ 150,088 169,239 110,835

Weighted average shares for diluted net income per common share ...... 6,873,786 6,500,822 6,391,071

Net income per common share:

Basic ..................................................... $ 0.55 $ 0.07 $ 0.01

Diluted ................................................... $ 0.51 $ 0.07 $ 0.01

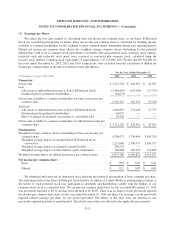

We identified and corrected an immaterial error affecting the historical presentation of basic earnings per share.

The adjustment reflects the Series B Preferred Stock held by an affiliate of Liberty Media as participating securities as

the holder of such preferred stock may participate in dividends and distributions ratably with the holders of our

common stock on an as-converted basis. Net income per common share-basic for the year ended December 31, 2011

was previously reported as $0.11 and has been adjusted to be $0.07. There was no impact on the previously reported

net income per common share-basic for the year ended December 31, 2010 and there was no impact on the previously

reported diluted earnings per share for any period presented. The effects of the error were not material to any

previously reported quarterly or annual period. The related corrections are reflected in the applicable prior periods.

F-15