XM Radio 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

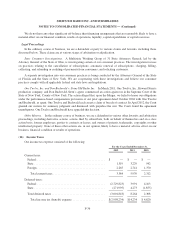

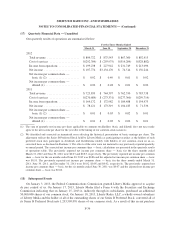

and conversion Liberty Media beneficially owned as of January 17, 2013, directly and indirectly, an aggregate of

3,292,800,311 shares of our common stock, representing approximately 50.21% of all the outstanding shares of

our common stock.

As a result of the foregoing, a Fundamental Change occurred on January 17, 2013 under the indenture

governing the Exchangeable Notes. In accordance with the indenture, on February 1, 2013, we made an offer to

each holder of Exchangeable Notes to: (i) have the Company repurchase his or her Exchangeable Notes at a

purchase price in cash equal to $1,000 per $1,000 principal amount of the Notes (plus accrued and unpaid interest

to, but excluding March 1, 2013); or (ii) exchange his or her Exchangeable Notes for our common stock, at an

exchange rate of 581.3112 shares per $1,000 principal amount of Notes, on or prior to March 1, 2013. This

exchange rate is a benefit to the holders compared to an exchange rate of 543.1372 shares of common stock in

effect prior to occurrence of such Fundamental Change. A holder of the Exchangeable Notes may also elect to

retain his or her Notes pursuant to their terms through maturity on December 1, 2014, or otherwise transfer or

exchange them in the ordinary course.

F-40