XM Radio 2012 Annual Report Download - page 73

Download and view the complete annual report

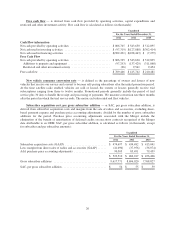

Please find page 73 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other general corporate purposes, including financing acquisitions, share repurchases and dividends. We expect

to fund operating expenses, capital expenditures, working capital requirements, interest payments, taxes and

scheduled maturities of our debt with existing cash, cash flow from operations and our Credit Facility, which we

believe will be sufficient to meet our cash requirements.

Our ability to meet our debt and other obligations depends on our future operating performance and on

economic, financial, competitive and other factors. We continually review our operations for opportunities to

adjust the timing of expenditures to ensure that sufficient resources are maintained.

We regularly evaluate our business plans and strategy. These evaluations often result in changes to our

business plans and strategy, some of which may be material and significantly change our cash requirements.

These changes in our business plans or strategy may include: the acquisition of unique or compelling

programming; the introduction of new features or services; significant new or enhanced distribution

arrangements; investments in infrastructure, such as satellites, equipment or radio spectrum; and acquisitions,

including acquisitions that are not directly related to our satellite radio business.

Special Dividend

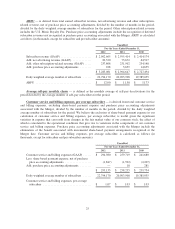

On December 28, 2012, we paid a special cash dividend of $0.05 per share of common stock. This was the

first cash dividend ever paid to our stockholders. Our Series B-1 Preferred Stock held by Liberty Radio, LLC, a

wholly-owned subsidiary of Liberty Media Corporation, participated in this cash dividend on an as-converted

basis in accordance with its terms. The total amount of this special dividend was approximately $327,000.

The dividend reflects the board’s desire to return value to stockholders and its confidence in the long-term

growth prospects of our business. We currently do not intend to declare recurring dividends on our common

stock. Our board of directors has not made any determination whether similar special cash dividends will be paid

in the future.

Our ability to pay dividends on our common stock is currently limited by covenants under our debt

agreements. We retain sufficient capital capacity to continue making long-term investments in our programming,

research and development initiatives and overall operations as well as pursue strategic opportunities which may

arise. See Note 12 to our consolidated financial statements included in this Annual Report.

Stock Repurchase Program

In December 2012, we announced that our board of directors approved a $2,000,000 common stock

repurchase program, which we will begin utilizing in 2013. Shares of common stock may be purchased from time

to time on the open market or in privately negotiated transactions.

7% Exchangeable Senior Subordinated Notes due 2014

As a result of Liberty Media Corporation’s beneficial ownership, a Fundamental Change occurred on

January 17, 2013 under the indenture governing the Exchangeable Notes. In accordance with the indenture, on

February 1, 2013, we made an offer to each holder of Exchangeable Notes to: (i) have the Company repurchase

his or her Exchangeable Notes at a purchase price in cash equal to $1,000 per $1,000 principal amount of the

Notes (plus accrued and unpaid interest to, but excluding March 1, 2013); or (ii) exchange his or her

Exchangeable Notes for our common stock, at an exchange rate of 581.3112 shares per $1,000 principal amount

of Notes, on or prior to March 1, 2013. This exchange rate is a benefit to the holders compared to an exchange

rate of 543.1372 shares of common stock in effect prior to occurrence of such Fundamental Change. A holder of

the Exchangeable Notes may also elect to retain his or her Notes pursuant to their terms through maturity on

December 1, 2014, or otherwise transfer or exchange them in the ordinary course. We believe that we have

sufficient resources to fund any required repurchases of the Exchangeable Notes.

17