XM Radio 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Long-Term Equity Grants — 2012 Stock Option Grants

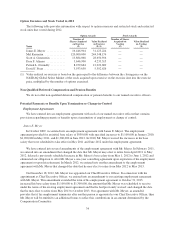

There were no long-term equity grants to any of our named executive officers in 2012.

Fiscal Year 2013 Considerations

The Compensation Committee expects to review our executive compensation program in 2013 with a view

to ensuring that it continues to provide the correct incentives and is properly sized given the scope and

complexity of our business and the competition we face. The Compensation Committee may employ the same

process, or may adopt a modified or wholly different process, in making future bonus decisions, provided that

with respect to 2013, the Compensation Committee has again adopted a bonus program which is intended to

comply with Section 162(m) for our Chief Executive Officer and the next five most highly compensated

executive officers (other than our Chief Financial Officer) under our 2009 Long-Term Stock Incentive Plan that

is designed to promote the achievement of our key financial goals for 2013. This bonus program provides for a

bonus pool which is based on a percentage of EBITDA. No bonus amount is payable under such program if we

do not achieve a specified level of EBITDA.

The Compensation Committee expects that our executive compensation program will continue to respond to

changes in economic conditions and our business with flexibility, as needed, to advance our objectives of

motivating, attracting and retaining highly qualified executives with the skills and experience necessary to

achieve our key business objectives and increase stockholder value.

Related Policies and Considerations

Compensation of our Chief Executive Officer

Several years ago we entered into an employment agreement with Mel Karmazin to serve as our Chief

Executive Officer. On December 18, 2012, Mr. Karmazin relinquished his role as our Chief Executive Officer.

The material terms of Mr. Karmazin’s employment agreement are described below under “Potential Payments

Upon Termination or Change-in-Control — Employment Agreements — Mel Karmazin.”

The terms of Mr. Karmazin’s employment were established by negotiations between Mr. Karmazin and the

Compensation Committee. The Compensation Committee did not retain an independent compensation consultant

to advise them in the negotiation of Mr. Karmazin’s compensation arrangements or to assess the reasonableness

of the compensation arrangements. The Compensation Committee concluded that, in its business judgment,

Mr. Karmazin’s qualifications and experience as chief executive officer, particularly in the radio industry, were

uniquely suited to our needs, and that his compensation, including the base salary and stock option components,

was, taken as a whole, appropriate under the circumstances.

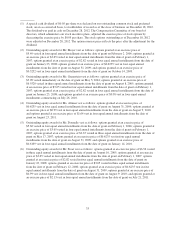

In February 2013, Mr. Karmazin was awarded a cash bonus of $9,500,000 in recognition of his performance

and our corporate performance in 2012, including:

• increasing our net subscribers additions by approximately 2 million, resulting in a total of nearly

23.9 million subscribers, an increase of over 9% as compared to 2011;

• achieving adjusted EBITDA growth of 26% to over $920 million in 2012;

• increasing our 2012 revenue by 13% over 2011 levels;

• increasing free cash flow by 71% to $709 million;

• retiring our 13% Senior Notes prior to their maturity in 2013 and our 9.75% Senior Notes prior to their

maturity in 2015;

29