XM Radio 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consistent with prior years, the bonuses approved by the Compensation Committee for 2012 were intended

to achieve two principal objectives:

• to link compensation with performance that enhances stockholder value, as measured at the Company

and individual levels; and

• to reward our named executive officers based on individual performance and contributions to the

Company.

In developing the compensation packages for the named executive officers, the Compensation Committee

considered the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code

(“Section 162(m)”). Section 162(m) generally disallows a tax deduction for annual compensation in excess of

$1 million paid to the Chief Executive Officer or any of the next three most highly compensated executive

officers (other than our Chief Financial Officer) unless the compensation qualifies as “performance-based

compensation” within the meaning of Section 162(m).

In 2012, the Compensation Committee again adopted, under our 2009 Long-Term Stock Incentive Plan, a

bonus program designed to qualify as “performance-based compensation” within the meaning of Section 162(m)

(the “NEO Bonus Plan”). Pursuant to the NEO Bonus Plan, a bonus pool was established for our Chief Executive

Officer and the four most highly compensated executive officers, other than our Chief Financial Officer,

consisting of 2.75% of our EBITDA, calculated in accordance with generally accepted accounting principles. The

maximum bonus that a named executive officer could receive under the NEO Bonus Plan was limited by the

percentages of the bonus pool set forth below (which percentages were not changed during the performance

year); and could not exceed the cash equivalent of 120 million shares (based on our closing share price as of the

last trading day of 2012). In addition, no amounts could be paid under the NEO Bonus Plan unless a threshold

amount of EBITDA was achieved for 2012, and the Compensation Committee retained the ability to exercise its

negative discretion to award bonuses in amounts less than the maximum percentages listed below:

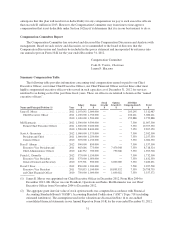

Former Chief Executive Officer ............................................ 40%

Chief Executive Officer (former President, Operations and Sales) ................. 20%

President and Chief Content Officer ......................................... 20%

General Counsel ........................................................ 15%

Chief Administrative Officer .............................................. 5%

After the end of the year, the Compensation Committee evaluated our actual performance against a set of

guidelines, including a variety of key operating metrics included in our budget and business plan for 2012. As

part of such evaluation, the Compensation Committee considered several metrics, including our increase in

subscribers, revenue, adjusted EBITDA and free cash flow; our results in controlling subscriber churn and

operating expenses; the introduction of new products and services during the year; and additional

accomplishments and other factors the Compensation Committee deemed relevant. In addition, Mr. Karmazin

and Mr. Meyer made recommendations to the Compensation Committee for individual bonus amounts for our

named executive officers (other than themselves), taking into account the responsibilities and contributions of

each individual during the year, our performance and (except in the case of our Chief Financial Officer) the

percentage limits contained in the NEO Bonus Plan. These amounts were reviewed and discussed with the

Compensation Committee and, following consideration by the Compensation Committee, the Compensation

Committee approved the amounts while exercising negative discretion regarding the permitted percentage limits

set forth in the NEO Bonus Plan. For our former Chief Executive Officer, Mr. Karmazin, the Compensation

Committee reviewed his performance for the year, determined that he should receive a bonus and established the

bonus amount, while exercising negative discretion regarding the permitted percentage limits contained in the

NEO Bonus Plan. Our board of directors also ratified Mr. Karmazin’s bonus for 2012. The Compensation

Committee determined that the bonuses to our named executive officers would be paid solely in cash. The bonus

awards to our named executive officers are described below under “Fiscal Year 2012 Pay Implications —

Payment of Performance-Based Discretionary Annual Bonuses for 2012” and are reflected in the Summary

Compensation Table.

25