XM Radio 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

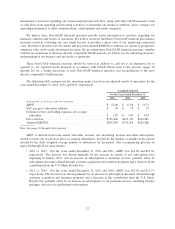

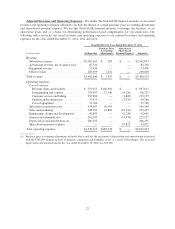

Adjusted EBITDA has certain limitations in that it does not take into account the impact to our statements of

comprehensive income of certain expenses, including share-based payment expense and certain purchase price

accounting for the Merger. We endeavor to compensate for the limitations of the Non-GAAP measure presented

by also providing the comparable GAAP measure with equal or greater prominence and descriptions of the

reconciling items, including quantifying such items, to derive the Non-GAAP measure. Investors that wish to

compare and evaluate our operating results after giving effect for these costs, should refer to net income as

disclosed in our consolidated statements of comprehensive income. Since adjusted EBITDA is a Non-GAAP

financial performance measure, our calculation of adjusted EBITDA may be susceptible to varying calculations;

may not be comparable to other similarly titled measures of other companies; and should not be considered in

isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with

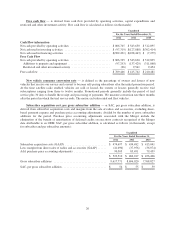

GAAP. The reconciliation of net income to the adjusted EBITDA is calculated as follows (in thousands):

Unaudited

For the Years Ended December 31,

2012 2011 2010

Net income (GAAP): .......................................... $3,472,702 $ 426,961 $ 43,055

Add back items excluded from Adjusted EBITDA:

Purchase price accounting adjustments:

Revenues (see pages 22-24) ................................ 7,479 10,910 21,906

Operating expenses (see pages 22-24) ........................ (289,278) (277,258) (261,832)

Share-based payment expense, net of purchase price accounting

adjustments ............................................. 63,822 53,369 63,309

Depreciation and amortization (GAAP) ......................... 266,295 267,880 273,691

Restructuring, impairments and related costs (GAAP) .............. — — 63,800

Interest expense, net of amounts capitalized (GAAP) .............. 265,321 304,938 295,643

Loss on extinguishment of debt and credit facilities, net (GAAP) ..... 132,726 7,206 120,120

Interest and investment (income) loss (GAAP) ................... (716) (73,970) 5,375

Other loss (income) (GAAP) .................................. 226 (3,252) (3,399)

Income tax (benefit) expense (GAAP) .......................... (2,998,234) 14,234 4,620

Adjusted EBITDA ............................................ $ 920,343 $ 731,018 $ 626,288

21