XM Radio 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Retired Debt

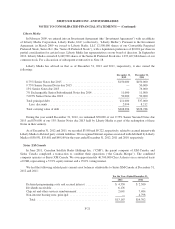

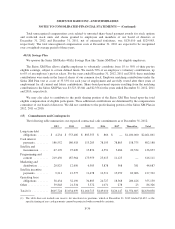

9.75% Senior Secured Notes due 2015

In August 2009, we issued $257,000 aggregate principal amount of 9.75% Senior Secured Notes due

September 1, 2015 (the “9.75% Notes”). The 9.75% Notes were issued for $244,292, resulting in an aggregate

original issuance discount of $12,708. Substantially all of our domestic wholly-owned subsidiaries guaranteed

our obligations under the 9.75% Notes. The 9.75% Notes and related guarantees were secured by first-priority

liens on substantially all of our assets and the assets of the guarantors.

During the year ended December 31, 2012, we purchased $257,000 in aggregate principal amount of the

9.75% Notes for an aggregate purchase price, including interest, of $281,698. We recognized an aggregate loss

on the extinguishment of the 9.75% Notes of $22,184 during the year ended December 31, 2012, consisting

primarily of unamortized discount, deferred financing fees and repayment premium, to Loss on extinguishment

of debt and credit facilities, net.

13% Senior Notes due 2013

In July 2008, we issued $778,500 aggregate principal amount of 13% Senior Notes due 2013 (the “13%

Notes”). The 13% Notes would have matured on August 1, 2013. Substantially all of our domestic wholly-owned

subsidiaries guaranteed our obligations under the 13% Notes.

During the year ended December 31, 2012, we purchased $778,500, in aggregate principal amount of the

13% Notes for an aggregate purchase price, including interest, of $879,133. We recognized an aggregate loss on

the extinguishment of the 13% Notes of $110,542 during the year ended December 31, 2012, consisting primarily

of unamortized discount, deferred financing fees and repayment premium, to Loss on extinguishment of debt and

credit facilities, net.

3.25% Convertible Notes due 2011

In 2011, we purchased $168,113 of our then outstanding 3.25% Convertible Notes due 2011 (the “3.25%

Notes”) at prices between 100.75% and 101% of the principal amount plus accrued interest. We recognized a loss

on extinguishment of debt for the 3.25% Notes of $2,291 for the year ended December 31, 2011, which consisted

primarily of cash premiums paid, unamortized discount and deferred financing fees. The remainder of the 3.25%

Notes was paid upon maturity in the fourth quarter of 2011.

11.25% Senior Secured Notes due 2013

In October 2010, we purchased $489,065 in aggregate principal amount of our 11.25% Senior Secured

Notes due 2013 (the “11.25% Notes”). The aggregate purchase price for the 11.25% Notes was $567,927. We

recorded an aggregate loss on extinguishment of the 11.25% Notes of $85,216, consisting primarily of

unamortized discount, deferred financing fees and repayment premium to Loss on extinguishment of debt and

credit facilities, net, in our 2010 consolidated statements of comprehensive income. The remainder of the 11.25%

Notes of $36,685 was purchased in January 2011 for an aggregate purchase price of $40,376. A loss from

extinguishment of debt of $4,915 associated with this purchase was recorded during the year ended

December 31, 2011.

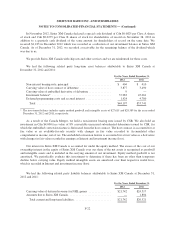

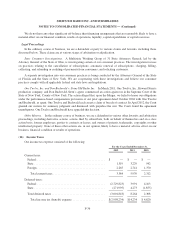

Covenants and Restrictions

Our debt generally requires compliance with certain covenants that restrict our ability to, among other

things, (i) incur additional indebtedness unless our consolidated leverage would be no greater than 5.0 times

F-28