XM Radio 2012 Annual Report Download - page 85

Download and view the complete annual report

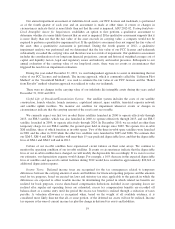

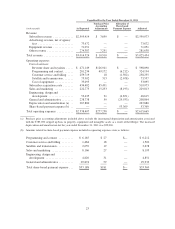

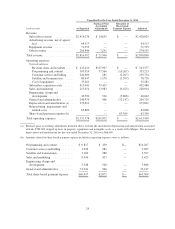

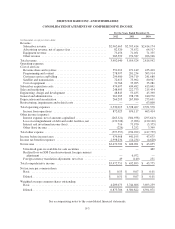

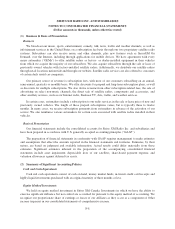

Please find page 85 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) The 2008 results and balances reflect the results and balances of XM Satellite Radio Holdings Inc. from the date of the

Merger and a $4,766,190 goodwill impairment charge.

(3) The net income (loss) per share-basic calculations were corrected for an immaterial error for the years ended

December 31, 2011 and 2010. See Notes 3 and 17 to our consolidated financial statements included in this Annual

Report.

(4) A special cash dividend was paid during 2012.

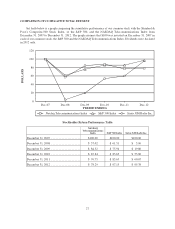

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISKS

We do not hold or issue any free-standing derivatives. We hold investments in marketable securities

consisting of money market funds, and certificates of deposit and investments in debt and equity securities of

other entities. We classify our investments in marketable securities as available-for-sale. These securities are

consistent with the investment objectives contained within our investment policy. The basic objectives of our

investment policy are the preservation of capital, maintaining sufficient liquidity to meet operating requirements

and maximizing yield.

Our debt includes fixed rate instruments and the fair market value of our debt is sensitive to changes in

interest rates. Under our current policies, we do not use interest rate derivative instruments to manage our

exposure to interest rate fluctuations.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

None.

29