XM Radio 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Debt Covenants

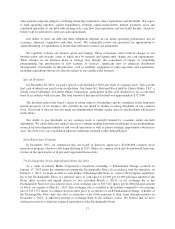

The indentures and the credit agreement governing our debt include restrictive covenants. As of

December 31, 2012, we were in compliance with the indentures and credit agreement governing our debt. For a

discussion of our “Debt Covenants”, refer to Note 12 to our consolidated financial statements in this Annual

Report.

Off-Balance Sheet Arrangements

We do not have any significant off-balance sheet arrangements other than those disclosed in Note 15 to our

consolidated financial statements in this Annual Report that are reasonably likely to have a material effect on our

financial condition, results of operations, liquidity, capital expenditures or capital resources.

Contractual Cash Commitments

For a discussion of our “Contractual Cash Commitments,” refer to Note 15 to our consolidated financial

statements in this Annual Report.

Related Party Transactions

For a discussion of “Related Party Transactions,” refer to Notes 10 and 18 to our consolidated financial

statements in this Annual Report.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with U.S. GAAP, which require

management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the

date of the financial statements and the reported amounts of revenues and expenses during the periods.

Accounting estimates require the use of significant management assumptions and judgments as to future events,

and the effect of those events cannot be predicted with certainty. The accounting estimates will change as new

events occur, more experience is acquired and more information is obtained. We evaluate and update our

assumptions and estimates on an ongoing basis and use outside experts to assist in that evaluation when we deem

necessary. We have disclosed all significant accounting policies in Note 2 to our consolidated financial

statements of this Annual Report.

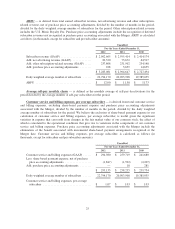

Goodwill. Goodwill represents the excess of the purchase price over the estimated fair value of net

tangible and identifiable intangible assets acquired in business combinations. Our annual impairment assessment

of our single reporting unit is performed as of the fourth quarter of each year. Assessments are performed at other

times if events or circumstances indicate it is more likely than not that the asset is impaired. Step one of the

impairment assessment compares the fair value of the entity to its carrying value and if the fair value exceeds its

carrying value, goodwill is not impaired. If the carrying value exceeds the fair value, the implied fair value of

goodwill is compared to the carrying value of goodwill; an impairment loss will be recorded for the amount the

carrying value exceeds the implied fair value. At the date of our annual assessment for 2012, the fair value of our

single reporting unit substantially exceeded its carrying value and therefore was not at risk of failing step one of

ASC 350-20, Goodwill. Subsequent to our annual evaluation of the carrying value of goodwill, there were no

events or circumstances that triggered the need for an interim evaluation for impairment. As a result, there were

no impairment charges to our goodwill during the years ended December 31, 2012 and 2011.

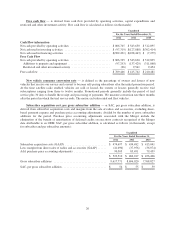

Long-Lived and Indefinite-Lived Assets. We carry our long-lived assets at cost less accumulated

amortization and depreciation. We review our long-lived assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset is not recoverable. At the time an impairment in the

value of a long-lived asset is identified, the impairment is measured as the amount by which the carrying amount

of a long-lived asset exceeds its fair value.

18