XM Radio 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

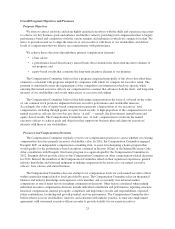

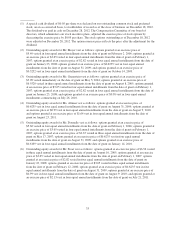

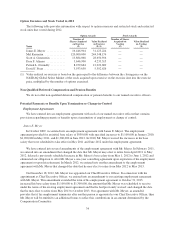

(1) A special cash dividend of $0.05 per share was declared on our outstanding common stock and preferred

stock, on an as-converted basis, to stockholders of record as of the close of business on December 18, 2012.

The dividend was paid in cash on December 28, 2012. The Compensation Committee of our board of

directors, which administers our stock incentive plans, adjusted the exercise price of stock options by

decreasing the exercise price by $0.05 per share. The stock options outstanding as of December 18, 2012

were adjusted on December 28, 2012. The option exercise price reflects the price after the adjustment for the

dividend.

(2) Outstanding equity awards for Mr. Meyer vest as follows: options granted at an exercise price of

$5.49 vested in four equal annual installments from the date of grant on February 2, 2006; options granted at

an exercise price of $3.65 vested in four equal annual installments from the date of grant on February 1,

2007; options granted at an exercise price of $2.82 vested in four equal annual installments from the date of

grant on January 23, 2008; options granted at an exercise price of $0.6235 vest in four equal annual

installments from the date of grant on August 31, 2009; and options granted at an exercise price of

$0.5252 vest in four equal annual installments from the date of grant on October 14, 2009.

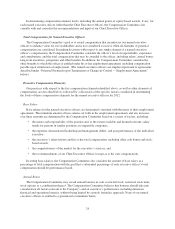

(3) Outstanding equity awards for Mr. Greenstein vest as follows: options granted at an exercise price of

$3.09 vested immediately on the date of grant on May 5, 2004; options granted at an exercise price of

$6.5520 vested in three equal annual installments from the date of grant on August 8, 2005; options granted

at an exercise price of $3.65 vested in four equal annual installments from the date of grant on February 1,

2007; options granted at an exercise price of $2.82 vested in four equal annual installments from the date of

grant on January 23, 2008; and options granted at an exercise price of $0.38 vest in four equal annual

installments commencing on July 26, 2010.

(4) Outstanding equity awards for Ms. Altman vest as follows: options granted at an exercise price of

$0.6235 vest in four equal annual installments from the date of grant on August 31, 2009; options granted at

an exercise price of $0.99 vest in four equal annual installments from the date of grant on August 9, 2010;

and options granted at an exercise price of $1.64 vest in four equal annual installments from the date of

grant on August 23, 2011.

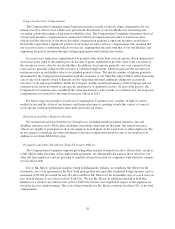

(5) Outstanding equity awards for Mr. Donnelly vest as follows: options granted at an exercise price of

$5.66 vested in four equal annual installments from the date of grant on February 1, 2006; options granted at

an exercise price of $3.65 vested in four equal annual installments from the date of grant on February 1,

2007; options granted at an exercise price of $2.67 vested in three equal annual installments from the date of

grant on May 17, 2007; options granted at an exercise price of $0.6235 vest in four equal annual

installments from the date of grant on August 31, 2009; and options granted at an exercise price of

$0.6169 vest in four equal annual installments from the date of grant on January 14, 2010.

(6) Outstanding equity awards for Mr. Frear vest as follows: options granted at an exercise price of $6.56 vested

in three equal annual installments from the date of grant on August 10, 2005; options granted at an exercise

price of $3.65 vested in four equal annual installments from the date of grant on February 1, 2007; options

granted at an exercise price of $2.82 vested in four equal annual installments from the date of grant on

January 23, 2008; options granted at an exercise price of $3.05 vested in three equal annual installments

from the date of grant on February 12, 2008; options granted at an exercise price of $0.6235 vest in four

equal annual installments from the date of grant on August 31, 2009; options granted at an exercise price of

$0.99 vest in four equal annual installments from the date of grant on August 9, 2010; and options granted at

an exercise price of $2.13 vest in four equal annual installments from the date of grant on July 21, 2011.

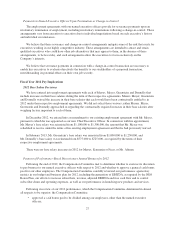

33