XM Radio 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

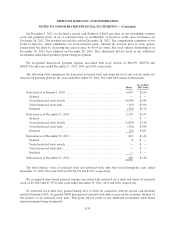

Total unrecognized compensation costs related to unvested share-based payment awards for stock options

and restricted stock units and shares granted to employees and members of our board of directors at

December 31, 2012 and December 31, 2011, net of estimated forfeitures, was $129,010 and $129,983,

respectively. The total unrecognized compensation costs at December 31, 2012 are expected to be recognized

over a weighted-average period of three years.

401(k) Savings Plan

We sponsor the Sirius XM Radio 401(k) Savings Plan (the “Sirius XM Plan”) for eligible employees.

The Sirius XM Plan allows eligible employees to voluntarily contribute from 1% to 50% of their pre-tax

eligible earnings, subject to certain defined limits. We match 50% of an employee’s voluntary contributions, up

to 6% of an employee’s pre-tax salary. For the years ended December 31, 2012, 2011 and 2010, these matching

contributions were made in the form of shares of our common stock. Employer matching contributions under the

Sirius XM Plan vest at a rate of 33.33% for each year of employment and are fully vested after three years of

employment for all current and future contributions. Share-based payment expense resulting from the matching

contribution to the Sirius XM Plan was $3,523, $3,041 and $2,356 for the years ended December 31, 2012, 2011

and 2010, respectively.

We may also elect to contribute to the profit sharing portion of the Sirius XM Plan based upon the total

eligible compensation of eligible participants. These additional contributions are determined by the compensation

committee of our board of directors. We did not contribute to the profit sharing portion of the Sirius XM Plan in

2012, 2011 or 2010.

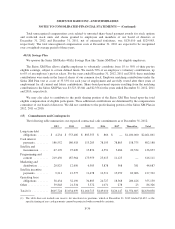

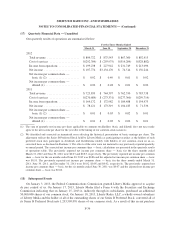

(15) Commitments and Contingencies

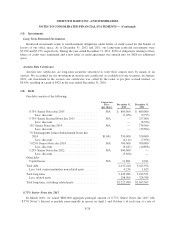

The following table summarizes our expected contractual cash commitments as of December 31, 2012:

2013 2014 2015 2016 2017 Thereafter Total

Long-term debt

obligations ....... $ 4,234 $ 553,406 $ 803,355 $ 866 $ — $1,100,000 $2,461,861

Cash interest

payments ......... 186,552 186,918 113,285 78,193 78,865 158,375 802,188

Satellite and

transmission ...... 67,170 27,620 13,874 4,351 3,484 20,334 136,833

Programming and

content .......... 219,450 187,964 173,959 23,613 11,125 — 616,111

Marketing and

distribution ....... 20,825 12,650 6,385 3,878 568 381 44,687

Satellite incentive

payments ......... 9,211 12,377 11,478 12,311 13,259 69,066 127,702

Operating lease

obligations ....... 38,434 32,190 34,805 24,727 18,568 206,426 355,150

Other .............. 59,848 21,534 3,572 1,071 278 23 86,326

Total (1) ........... $605,724 $1,034,659 $1,160,713 $149,010 $126,147 $1,554,605 $4,630,858

(1) The table does not include our reserve for uncertain tax positions, which at December 31, 2012 totaled $1,432, as the

specific timing of any cash payments cannot be projected with reasonable certainty.

F-34