XM Radio 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

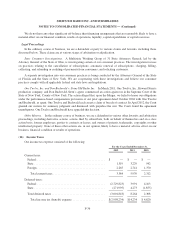

(11) Investments

Long Term Restricted Investments

Restricted investments relate to reimbursement obligations under letters of credit issued for the benefit of

lessors of our office space. As of December 31, 2012 and 2011, our Long-term restricted investments were

$3,999 and $3,973, respectively. During the year ended December 31, 2011, $250 of obligations relating to these

letters of credit were terminated and a new letter of credit agreement was entered into for $826 for additional

space.

Auction Rate Certificates

Auction rate certificates are long-term securities structured to reset their coupon rates by means of an

auction. We accounted for our investment in auction rate certificates as available-for-sale securities. In January

2010, our investment in the auction rate certificates was called by the issuer at par plus accrued interest, or

$9,456, resulting in a gain of $425 in the year ended December 31, 2010.

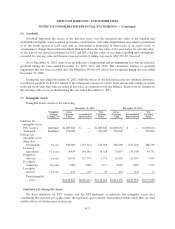

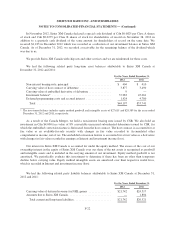

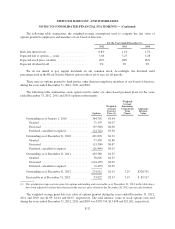

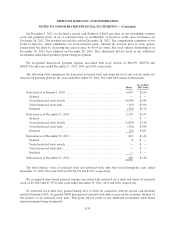

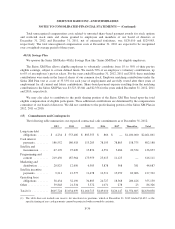

(12) Debt

Our debt consists of the following:

Conversion

Price

(per share)

December 31,

2012

December 31,

2011

8.75% Senior Notes due 2015 ..................... N/A $ 800,000 $ 800,000

Less: discount .............................. (7,056) (9,753)

9.75% Senior Secured Notes due 2015 .............. N/A — 257,000

Less: discount .............................. — (8,356)

13% Senior Notes due 2013 ....................... N/A — 778,500

Less: discount .............................. — (39,504)

7% Exchangeable Senior Subordinated Notes due

2014 ....................................... $1.841 550,000 550,000

Less: discount .............................. (4,112) (5,956)

7.625% Senior Notes due 2018 .................... N/A 700,000 700,000

Less: discount .............................. (9,647) (10,898)

5.25% Senior Notes due 2022 ..................... N/A 400,000 —

Less: discount .............................. (5,826) —

Other debt:

Capital leases .................................. N/A 11,861 2,941

Total debt ....................................... 2,435,220 3,013,974

Less: total current maturities non-related party ........ 4,234 1,623

Total long-term ................................... 2,430,986 3,012,351

Less: related party .............................. 208,906 328,788

Total long-term, excluding related party ............... $2,222,080 $2,683,563

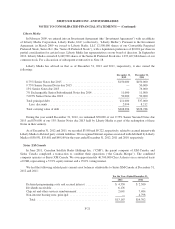

8.75% Senior Notes due 2015

In March 2010, we issued $800,000 aggregate principal amount of 8.75% Senior Notes due 2015 (the

“8.75% Notes”). Interest is payable semi-annually in arrears on April 1 and October 1 of each year at a rate of

F-26