XM Radio 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

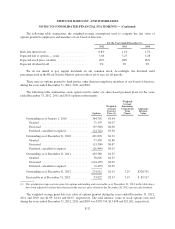

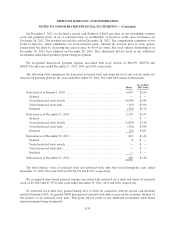

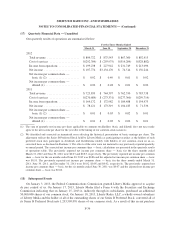

The following table indicates the significant elements contributing to the difference between the federal tax

(benefit) expense at the statutory rate and at our effective rate:

For the Years Ended December 31,

2012 2011 2010

Federal tax expense, at statutory rate ................... $ 166,064 $ 154,418 $ 16,678

State income tax expense, net of federal benefit ........... 16,606 15,751 1,620

State income rate changes ............................ 2,251 3,851 (2,252)

Non-deductible expenses ............................. 477 457 4,130

Change in valuation allowance ........................ (3,195,651) (166,452) (21,749)

Other, net ......................................... 12,019 6,209 6,193

Income tax (benefit) expense ....................... $(2,998,234) $ 14,234 $ 4,620

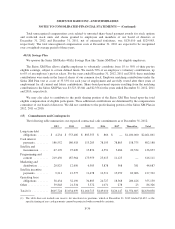

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

deferred tax liabilities are represented below:

For the Years Ended December 31,

2012 2011

Deferred tax assets:

Net operating loss carryforwards .......................... $2,493,239 $ 3,025,621

GM payments and liabilities .............................. 80,742 194,976

Deferred revenue ....................................... 511,700 410,812

Severance accrual ...................................... 46 21

Accrued bonus ......................................... 23,798 17,296

Expensed costs capitalized for tax ......................... 26,569 35,227

Loan financing costs .................................... 428 1,575

Investments ........................................... 39,915 40,880

Stock based compensation ............................... 64,636 89,862

Other ................................................ 34,705 42,924

Total deferred tax assets ............................... 3,275,778 3,859,194

Deferred tax liabilities:

Depreciation of property and equipment ..................... (185,007) (405,892)

FCC license ........................................... (772,550) (781,742)

Other intangible assets .................................. (165,227) (188,988)

Other ................................................ — (189)

Total deferred tax liabilities ............................ (1,122,784) (1,376,811)

Net deferred tax assets before valuation allowance .............. 2,152,994 2,482,383

Valuation allowance ...................................... (9,835) (3,360,740)

Total net deferred tax asset (liability) ....................... $2,143,159 $ (878,357)

F-37