XM Radio 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

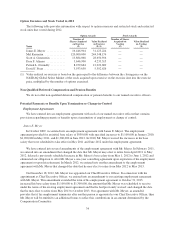

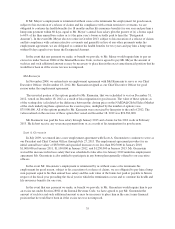

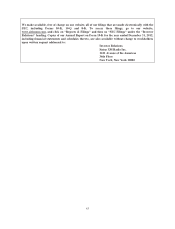

Option Exercises and Stock Vested in 2012

The following table provides information with respect to option exercises and restricted stock and restricted

stock units that vested during 2012.

Option Awards Stock Awards

Name

Number of

Shares Acquired

on Exercise

(#)

Value Realized

on Exercise

($)(1)

Number of Shares

Acquired on

Vesting

(#)

Value Realized

on Vesting

($)

James E. Meyer ............. 16,446,904 31,125,224 — —

Mel Karmazin .............. 120,000,000 244,348,176 — —

Scott A. Greenstein .......... 13,884,068 28,650,916 — —

Dara F. Altman ............. 3,646,900 4,233,515 — —

Patrick L. Donnelly .......... 8,259,664 12,222,689 — —

David J. Frear ............... 3,933,650 5,392,626 — —

(1) Value realized on exercise is based on the gain equal to the difference between the closing price on the

NASDAQ Global Select Market of the stock acquired upon exercise on the exercise date less the exercise

price, multiplied by the number of options exercised.

Non-Qualified Deferred Compensation and Pension Benefits

We do not offer non-qualified deferred compensation or pension benefits to our named executive officers.

Potential Payments or Benefits Upon Termination or Change-in-Control

Employment Agreements

We have entered into an employment agreement with each of our named executive officers that contains

provisions regarding payments or benefits upon a termination of employment or change of control.

James E. Meyer

In October 2009, we entered into an employment agreement with James E. Meyer. The employment

agreement provided for an initial base salary of $950,000 with specified increases to $1,100,000 in January 2010,

$1,200,000 in May 2011, and $1,300,000 in June 2012. In 2010, Mr. Meyer waived the increases in his base

salary that were scheduled to take effect in May 2011 and June 2012 under his employment agreement.

We have entered into several amendments of the employment agreement with Mr. Meyer. In February 2011,

we entered into an amendment that changed the date that Mr. Meyer may elect to retire from April 2011 to May

2012, delayed a previously scheduled increase in Mr. Meyer’s base salary from May 1, 2012 to June 1, 2012 and

eliminated our obligation to offer Mr. Meyer a one-year consulting agreement upon expiration of his employment

agreement or upon his retirement. In March 2012, we entered into another amendment to the employment

agreement with Mr. Meyer that changed the date that he may elect to retire from May 2012 to May 2013.

On December 18, 2012, Mr. Meyer was appointed our Chief Executive Officer. In connection with his

appointment as Chief Executive Officer, we entered into an amendment to our existing employment agreement

with Mr. Meyer. This amendment extended the term of his employment agreement to October 31, 2013;

increased his base salary from $1,100,000 to $1,300,000, the amount that Mr. Meyer was scheduled to receive

under the terms of his existing employment agreement and that he had previously waived; and changed the date

that he may elect to retire from May 2013 to October 2013. Our agreement with Mr. Meyer, as amended,

provides that if his employment terminates after another person is appointed as our Chief Executive Officer, then

Mr. Meyer will be entitled to an additional bonus to reflect his contributions in an amount determined by the

Compensation Committee.

34